What’s the Number One Question for Precious Metals Beginners?

What’s the First Thing Beginners Should Know about Precious Metals?

More people are investing in gold and silver these days. Many of these are first-time investors and have several questions. One of the first questions often asked is “What do I do with my precious metals?” We take a moment to answer this question.

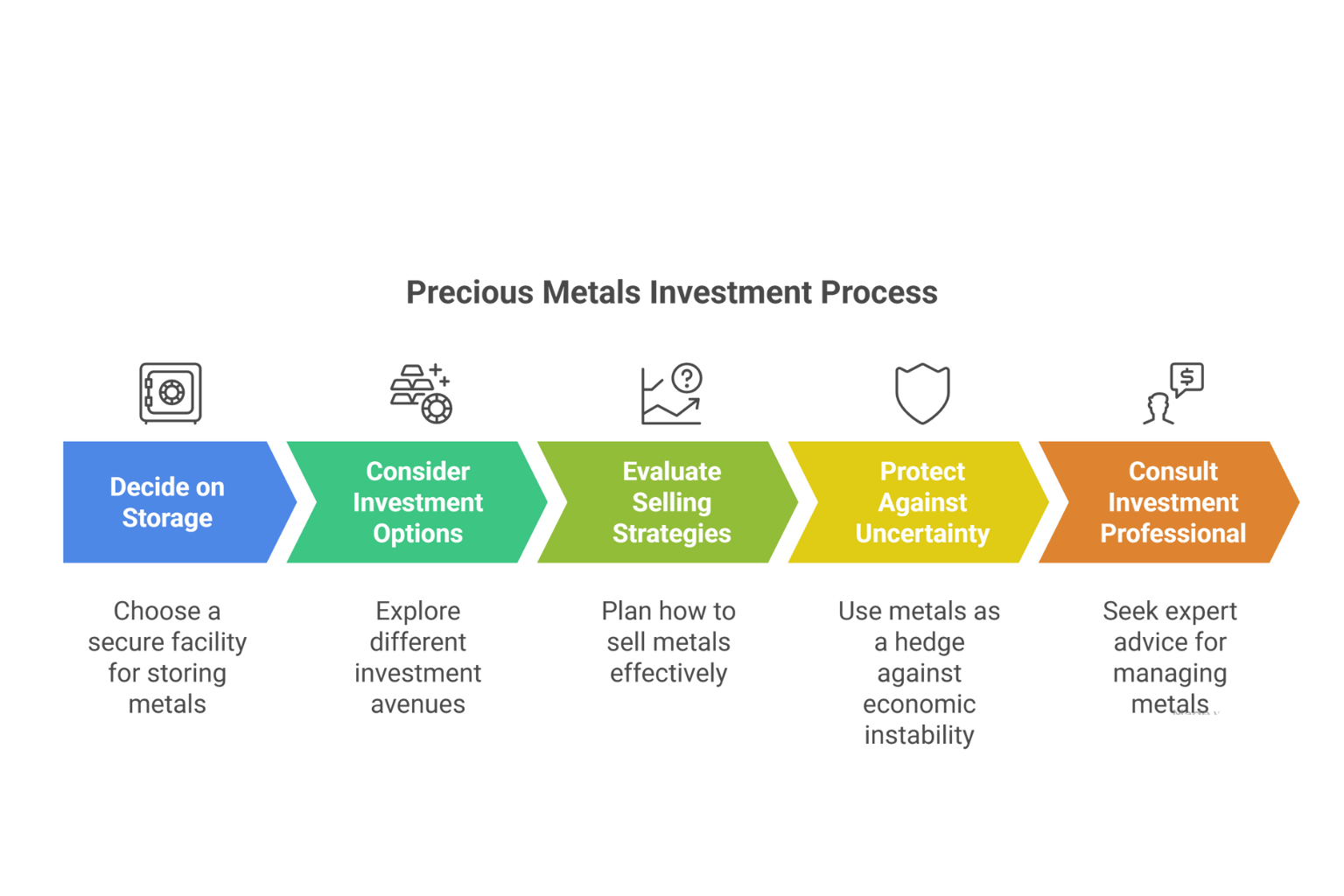

Storage

The first thing to do is decide where you’ll store your precious metals. A secure facility is usually the best bet. For example, if they’re looking for a safe place to store gold or silver bars, Scottsdale residents can use trusted depositories such as those available through First National Bullion. These facilities often have extra security features and insurance. You don’t necessarily have to sell your gold and silver. You can always keep it in storage until you’re ready to sell in the future or just leave it there for those “just in case” moments.

Investment

Physical gold and silver cannot be traded on the stock market. If you have gold or silver stocks, they’re for the mining companies that produce gold and silver. Gold and silver EFTs can be stuffed with IOUs or paper currency. That being said, gold and silver holdings can be added to your investment portfolio. You’ll only make a profit if you sell at the right time. Remember, you won’t have to pay taxes on your gold or silver unless you sell it. Gold and silver can also be traded, or it can be stored in case paper currency collapses.

Selling

It’s fairly easy to sell gold and silver. Dealers are available in person and online. You can usually get a good deal if you do your homework. Go with reliable buyers and dealers such as the experienced pros at First National Bullion, the silver and gold dealers Scottsdale collectors trust for all their precious metals needs. You can also check spot prices to see if you’re getting a good deal. Avoid online sites that have third-party sellers and buyers. When selling your gold and silver, have a general idea of what it’s worth. You can always have it appraised so you’ll have documentation you can use to get a better deal.

Protecting against Uncertainty

As mentioned above, nobody really knows for sure what would happen if the dollar collapses. However, gold and silver can protect you against uncertainty of this nature. We could end up relying on cryptocurrency. Even if this is the case, electronic currency could fall as well if the power grid fails. This brings us back to gold and silver. These are reliable sources of wealth and valuable materials for bartering. Silver would likely be used for daily purchases, and gold could be valuable if we go back to the gold standard. Gold also works as a hedge against inflation and other economic uncertainties.

Work with an Investment Professional

One other thing you can do with your gold and silver is discuss what to do with it with an investment expert. Make sure to ask about things such as how much you can expect to pay for the services. Be aware of any fees as well. Some investment professionals charge fees for sales and purchases.

If you’re a beginning precious metals collector and you’re looking for the best place to buy silver bars, gold coins, and other forms of precious metals, reach out to the trustworthy professionals at First National Bullion. We can answer all your questions and help you find all the information you need on how precious metals can be great investments. Give one of our experienced dealers a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.