Buy Gold and Silver: The Straw that Breaks the Camel’s Back: Part Four:

Buy GOLD and SILVER: The Straw that Breaks the Camel’s Back: Part Four:

Gold: $ `457.20 Silver: $ 16.91 :Platinum $ 880.00 Palladium: $ 1694.00

Dateline: Del Mar, CA: Monday, November 11, 2019

FNB is a precious metals industry leader. Each weekday, we post information and financial facts (and opinions!) that relate directly to the financial markets and also that have direct impact upon the daily lives of investors.

In our last session, FNB continued a series called: “The Straw that Breaks the Camel’s Back.”

The questions we are raising and pressing into surround the fact that there is a place and a time and a date somewhere in the future where markets will simply not be able to endure the endless seasons of manipulation and fiscal rigging that currently happens on a daily basis.

In our last session, FNB brought to the forefront of investors’ awareness, the fact that gold and silver prices are rigged.

In this session, FNB alerts all investors and private holders of wealth producing assets the inherent and ongoing danger of the reckless and feckless global central banks.

The Reckless Mind of CENTRAL BANKERS:

FNB is not anti-banker.

FNB is certainly not anti-central banks.

FNB is anti-reckless central bankers.

FNB sees the reckless and feckless mindset of global bankers to enrich themselves and their cronies as certain, clear and present dangers.

FNB posits that reckless central bankers are a clear and present danger to the long-term financial prosperity of the United States of America.

Let’s Look at Some Reckless Behaviors of Central Bankers:

Debt: Central Bankers create debt. Central Bankers love to lend

Payments: Central Bankers love to create debt and then reap the harvest of long-term indebtedness. The harvest of long-term indebtedness is evergreen payments

Entrap and Swallow Entire National Economies: Central Bankers love to gain full and absolute control of national economies. Once Central Bankers own a nation, then nothing short of complete indenture is acceptable to them

Mortgages and exorbitant rates: Central Bankers love to own the mortgage systems for nations. Owning the mortgage systems for nations means that de facto the Central Bankers own the majority of real property

Interest Rate Manipulation: Central Bankers love to raise and lower interest rates according to some deviant (and unknown) plan to extract as much cash as possible out of the citizens of the nation-state they control

QE and FIAT!: Central Bankers love to print money. They love to dilute currencies. They love to depress national valuations

Worthless Currencies: Central Bankers love to so devalue national currencies that the only groups that can prosper are them and their cronies

Imploding Economic Structures: Central Bankers love to implode formerly safe and stable national economies. As Central Bankers implode stable economies their devious print and dilute and in-debt strategies can then be effectively implemented

Economic Deflation: Central Bankers love to deflate booming economies. Central Bankers know that with deflating assets comes high levels of risk. As at-risk populations seek economic solutions to their woes, then Central Bankers can expand their debt lassos

Separate from Gold and Silver: Central Bankers despise ‘gold standards’. ‘Gold standards’ restrict and even prohibit Central Bankers from the pollution of currency dilution

More Debt than Currency: Central Bankers love when a national economy’s debt load far exceeds the levels of available currency to meet their debt demands

Central Bankers are feckless. The reckless mindset of Central Banks erodes and eventually undermines even the most robust of national economies.

In our next session, FNB addresses the coming Chinese Cryptocurrency.

Investors, beware! Investors, be informed! Investors, buy gold and silver!

FNB strongly urges all savvy and thoughtful investors to ramp up their physical gold coins, bars and bullion holdings. FNB invites all to visit our website:

www.firstnationalbullion.com

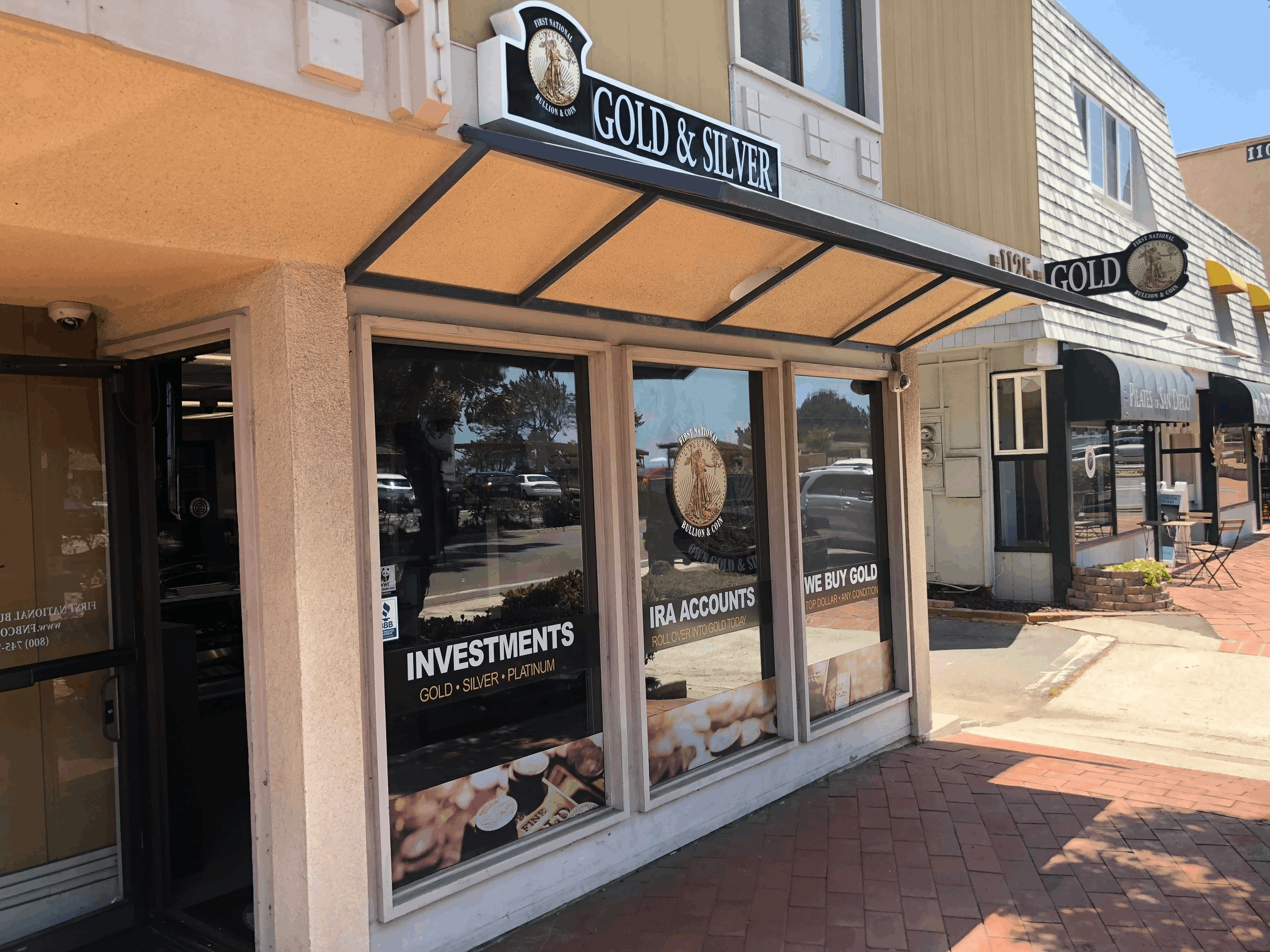

FNB invites all that live in or near our three physical locations in San Diego, Del Mar and Scottsdale to stop in and visit and meet one-on-one with our Team of precious metals experts.

FNB posits and strongly asserts that capitalism and the capacity to own, manage and profit from the collective of private properties and/or business initiatives is a driving force that America and its leaders simply must protect.

FNB remains diligent and unwavering in the call for common, average American people to seek out the Safe Havens of gold and silver coins, and gold and silver bullion.

FNB, a national precious metals industry leader and reputable gold and silver coin dealer urges investors, bond-holders, speculators and all who manage and/or oversee their family’s financial portfolio begin now migrating larger allocations into the historical safe harbors of: Gold and Silver.

Jon Cavuoto,

Founder and Owner,

First National Bullion

inquiry@fnbcoin.com