Lies “Rare” Coin Dealers Commonly Tell

What Misleading Claims Do “Rare” Coin Dealers Often Make?

Rare coins are all right for collectors with a knowledge of their history and a willingness to hold on to these coins because of their unique qualities. Otherwise, it’s best to avoid rare coins if you just want gold and silver as a hedge against inflation. Below, the reputable professionals from First National Bullion, Carlsbad gold coin dealers with experience and market know-how you can rely on, go over the common untruths told by coin dealers about rare coins.

What Are Rare Coins?

Before we get to the list of lies, let’s discuss what a rare coin is. Rare coins are generally those with limited editions or those that are older and less circulated. Rare coins can also be ones with unique flaws, such as a wrong date or printing error, that increase their value. Rare coins aren’t necessarily a bad investment. It just helps to know ahead of time what you may be told by dealers or other sellers. Some of the misconceptions they tell result in higher prices beyond what’s expected or what’s fair.

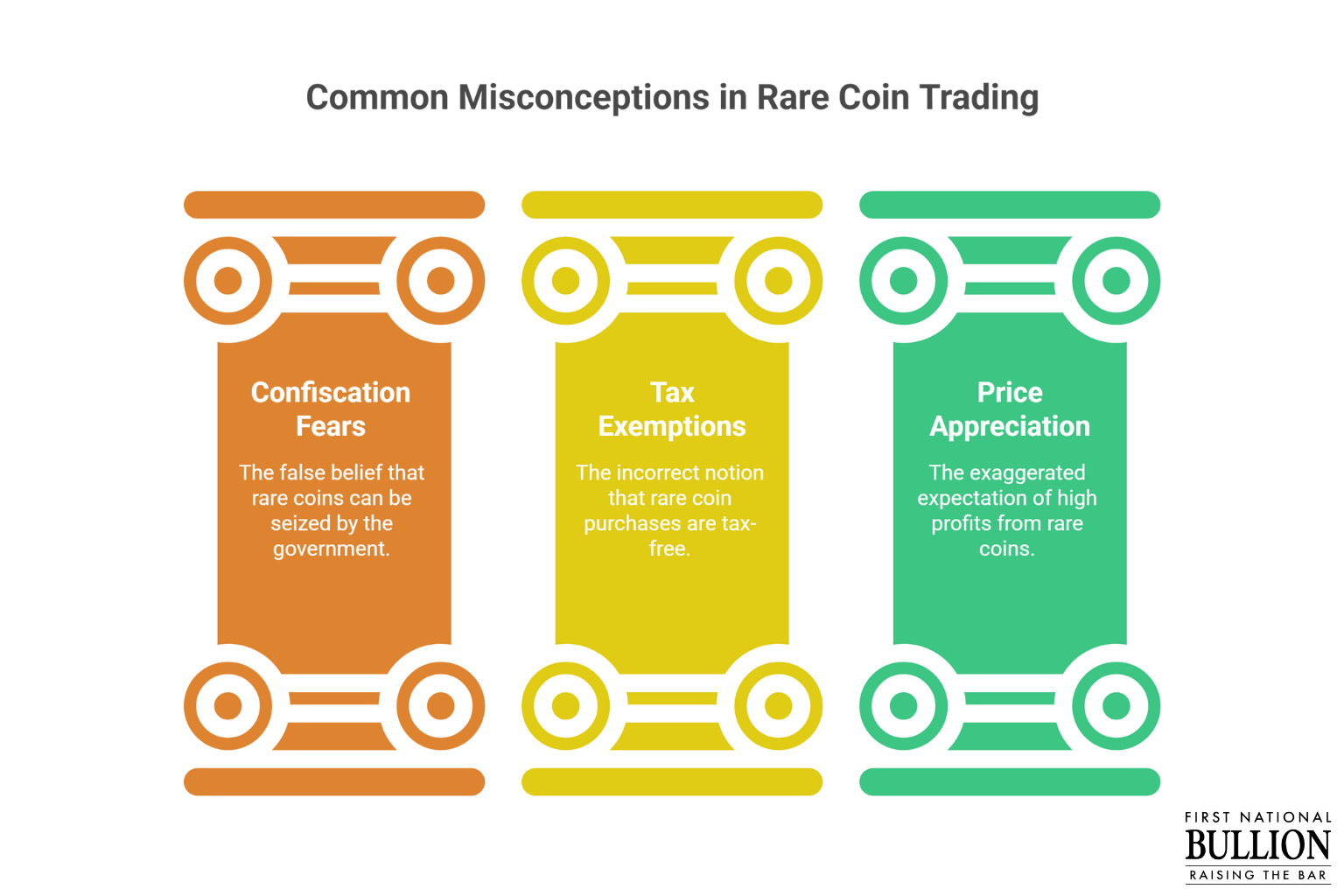

Rare Coins Can Be Confiscated

This fabrication dates back to the days of FDR. President Roosevelt declared private ownership of gold was limited and anything else needed to be turned over. FDR also reduced the value of the dollar and adjusted the price of gold, since the United States was on the gold standard at the time. However, President Nixon took the U.S. off the gold standard in the early 1970s, and the executive order FDR signed was nullified. If the government really wanted to confiscate wealth today, it would likely go after electronic assets that are easier to find and collect than physical gold or silver coins.

You Don’t Need to Pay Taxes on Rare Coins

In rare instances, dealers are required to file tax documents for coin purchases. Normally, dealers don’t file any tax documents when coins are purchased. The exceptions are purchases of over $10,000 and large bars of gold or silver. However, you still need to pay capital gains taxes if you sell your rare coins later and make a profit. Gains on coins held longer than one year are taxed at the collectibles rate of 28 percent. Short-term gains are taxed as ordinary income.

Rare Coins Offer Greater Price Appreciation

Rare coins have unique selling markets, and only serious collectors know how to find sellers willing to charge a fair price for rare coins. The buy/sell spread is also incredibly high for rare coins, making it difficult to earn a decent profit. Also, the melt value of rare coins isn’t always that great. It’s often necessary for sellers to wait for the price of metal to double just to break even. And because of the high buy/sell spread, any profits made are often significantly lower than expected. It can also be difficult to find buyers willing to pay more than the actual value of the coin unless they’re familiar with its history or any other unique qualities.

Whether you’re a veteran coin collector or you’re just getting interested in taking up the hobby, you’ll find a fantastic variety of high-quality numismatic rare coins at First National Bullion. We also offer a huge selection of gold, silver, platinum, and palladium bars Carlsbad collectors will appreciate for their exceptional quality. If you’re looking for the finest-quality gold coins, give us a call to speak with one of our rare coin experts.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.