Why Dollar Cost Averaging Is Vital for Precious Metals Portfolios

How Dollar Cost Averaging Strengthens Precious Metals Investments

Adding precious metals to your investment portfolio is a good thing. However, you may not be getting the most out of your financial investments involving precious metals if you’re not familiar with dollar cost averaging. Whether they’re interested in purchasing silver bars or they want to buy gold bullion, Scottsdale residents can benefit from this look at dollar cost averaging and how it can be applied to precious metals investments.

Are You Losing Money on Your Existing Precious Metals Investments?

One of the telltale signs you can benefit from dollar cost averaging is that you’re not making significant gains with your precious metals investments. You may even find yourself losing money. One reason may be that you’re not taking advantage of various price points for precious metals.

What Is Dollar Cost Averaging?

Dollar cost averaging refers to the average of all your precious metals investments based on the kind of precious metals you’re investing in at the moment. For instance, if you have three silver bars valued at $30, $22, and $25, the dollar cost average would be $26. In other words, you would need to sell each of those silver assets for more than $26 to make a profit. With dollar cost averaging, you purchase precious metals over time and take the average of those assets before you sell or buy.

How Can You Make Dollar Cost Averaging Work for You?

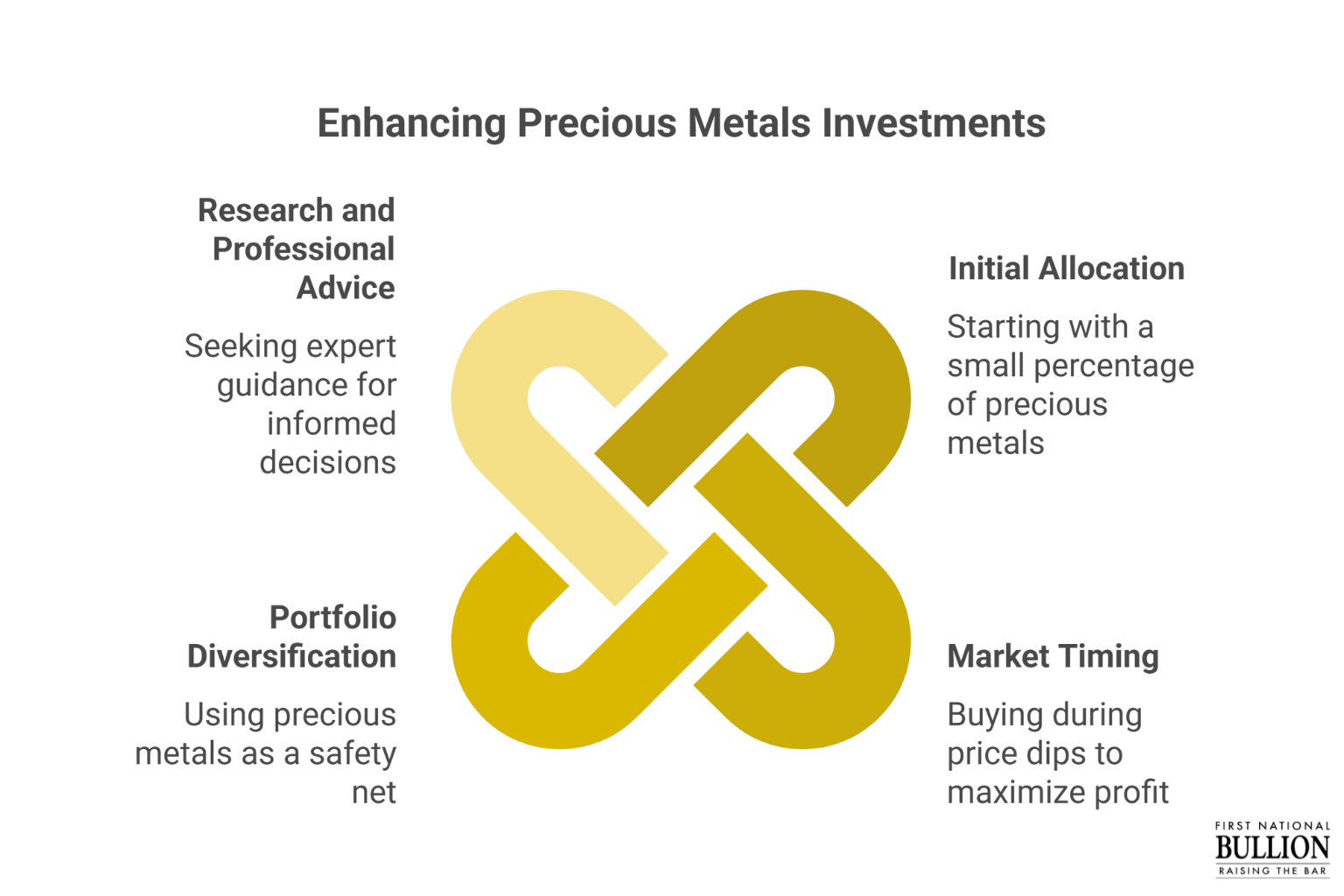

It’s recommended that new precious metals investors begin with a 5 percent or 10 percent allocation of precious metals if you’re just getting started. If you achieve good results, you can always adjust your allocations to suit your needs. Next, pay attention to the market prices for each of your allocations. If you time your investments wisely, you can make a decent profit. With precious metals, prices fluctuate. You only do better if you time your investments to account for the valleys that naturally occur with precious metals.

How Does Dollar Cost Averaging Work with Your Other Investments?

Dollar cost averaging works well with your other investments by providing a security or safety net. For instance, if the dollar plummets in value or you lose money on your stocks, you can sell some of your precious metals at the right moment based on your average cost of acquisition to earn some extra cash. Precious metals are highly liquid in the sense that you can usually find buyers willing to pay the going market rate for your precious metals.

How Do You Get Started?

Do your research to determine what’s going to work well for you. Gold is a popular choice, since it generally performs well even if other assets aren’t doing so well. Silver also works well, and it’s more affordable than gold. Make sure to buy your precious metals from reputable sellers to ensure you’re getting the most value for your investment. There are risks associated with every investment, even precious metals. Consider discussing dollar cost averaging with an investment professional who’s familiar with precious metals before you get started.

If you’re building an investment portfolio and looking for the best place to purchase Scottsdale silver bars, gold coins, and other forms of precious metals, reach out to the trustworthy professionals at First National Bullion. We can answer all your questions and help you find all the information you need on how precious metals can be great investments. Give one of our experienced dealers a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.