Precious Metals vs. Bitcoin: Better Long-Term Store of Value?

Why Precious Metals Offer Greater Long-Term Security than Bitcoin

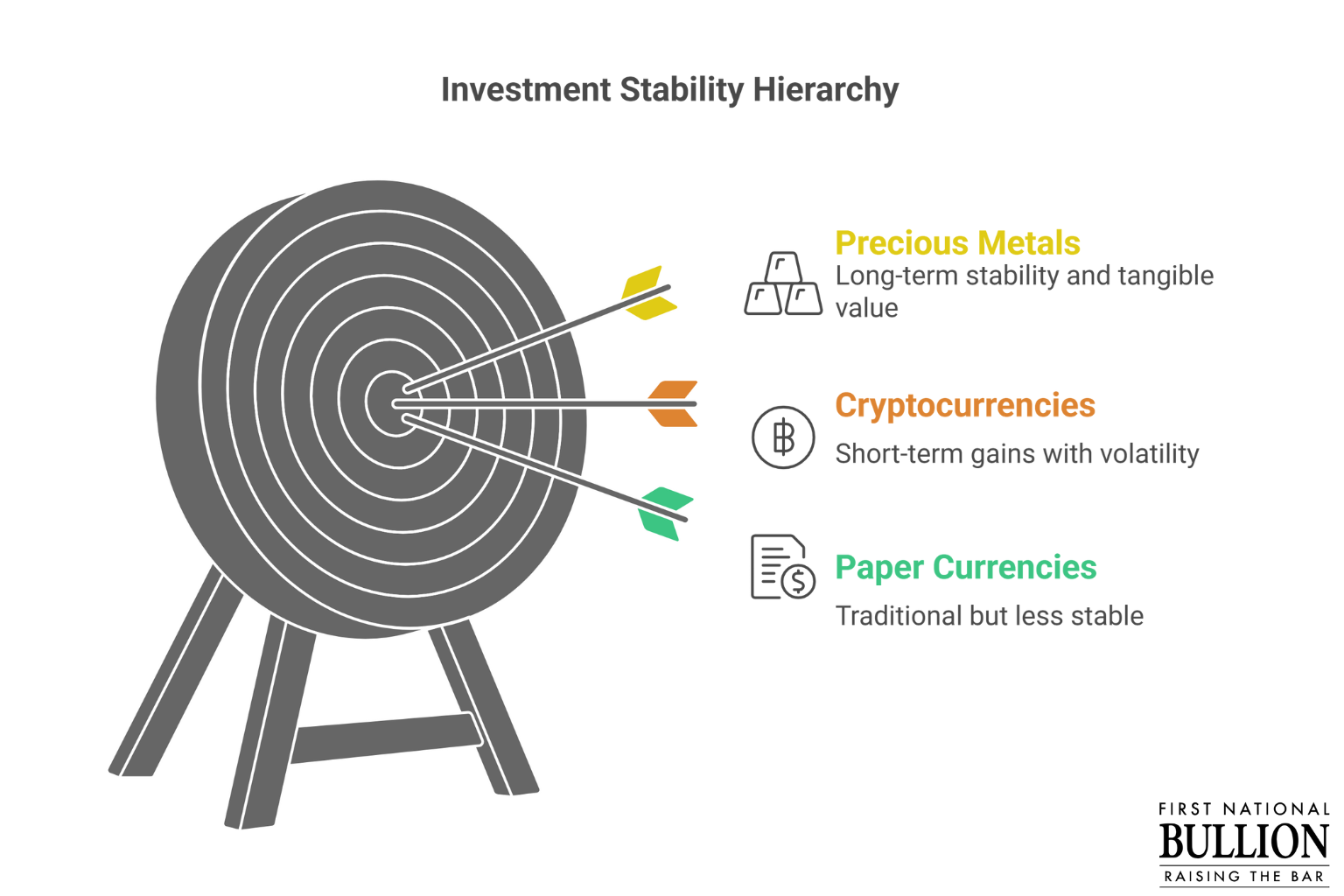

Bitcoin is probably the best known of the cryptocurrencies available today. It’s in the news again because many investors are moving toward Bitcoin and similar electronic money sources. While there may be much to appreciate about Bitcoin, gold, silver, and other precious metals are still better long-term investments. Keep reading as the precious metals experts from First National Bullion, the silver and gold dealers Scottsdale collectors rely on for outstanding quality and service, explain why precious metals are a more reliable store of long-term value than Bitcoin.

Why Some Investors Like Cryptocurrencies

Cryptocurrencies have gone up in a short period. However, gold has been on the rise since 2000. According to a comparison of gold and Bitcoin and other crypto sources, Bitcoin rates better than gold and paper currencies. However, this is only the case if the electric grid remains viable and the internet remains accessible. Precious metals, on the other hand, can be mined without too much reliance on modern technology if need be. On the plus side, the Bitcoin price as of mid-2025 is $107,849.65 with a 24-hour trading volume of $43,169,477,766.

Why Precious Metals Are Better for Long-Term Investments

There’s no way to know how long Bitcoin will be on the rise. If there are issues with the power grid, for instance, cryptocurrencies are useless. Also, it takes a lot of energy to make Bitcoin, which is an additional drain on the power system. Additionally, gold currently has a total of $2.9 trillion for all investments, versus $143 billion for the crypto market and $47 billion for silver.

Gold is also a more stable currency. All it takes is one major power outage or a power shortage to shake up the crypto market. However, precious metals are tangible and still of use when the power grid is down. If all other markets crash, gold, silver, and other precious metals can be used to make purchases.

There’s also the Dow Jones average, which is reaching new heights. The downside is that market corrections often come every seven years or so, and even a minor market adjustment could shake up the investments people have in Bitcoin and other currencies that are affected by such adjustments. Gold and silver, on the other hand, are reliable hedges against inflation and market events.

Gold also has a long history of being consistently reliable. It’s been a staple of economic stability and confidence for hundreds of years. There are also plans to back up some electronic currencies with gold and silver for added security and peace of mind.

If you have any concerns about precious metals or Bitcoin and other cryptocurrencies and how they can fit into your investment plans, talk to an investment professional. Look for one familiar with both kinds of investments for a more accurate assessment.

Whether they need expert advice on the various benefits of owning precious metals or they’re looking for the best place to buy silver, gold, or platinum bars, Scottsdale collectors should work with trustworthy experts who offer high-quality service and have years of experience. Reach out to the industry-leading professionals at First National Bullion when you’re ready to invest in precious metals. Give us a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.