Buy Gold and Silver: Coming Bull Metals Market: Part Seven:

Buy BUY GOLD and SILVER: Coming Bull Metals Market: Part Seven:

Gold: $ 1483.50 Silver: $ 17.32 Platinum : $ 883.00 Palladium: $ 1665.00

Dateline: Del Mar, CA: Tuesday, October 01, 2019

FNB is a precious metals industry leader. Each weekday, we post information and financial facts (and opinions!) that relate directly to the financial markets and also that have direct impact upon the daily lives of investors.

In our last session, FNB continued a new series on the coming bull market run for both gold and silver by addressing and took a first look–we will return to this topic in much greater detail in the days to come–at the global banking cartel and their move towards consolidation of currencies.

In this session, FNB the true and quite devastating impact of central banks and their ongoing menace known as: ‘Fiat’!

The Ongoing Menace of ‘Fiat’ Currency and RELENTLESS MONEY PRINTING:

FNB now examines the devastating role and impact that constant printing of currency has on investors.

Investors often underestimate the damaging impact that unbridled and feckless printing of currency can have on their investments in general, and their cash holdings specifically.

Constant printing of ‘Fiat’ currency increases the cost of living and it simultaneously reduces the spending power of any current savings that you might have been able to accumulate.

FNB wants investors to realize that inflation and constant ‘Fiat’ printing can help long-term, hard assets like gold, silver or real estate. Inflation can and often does cause these hard assets to rivet and ratchet up in price and valuation.

FNB wants investors to also realize those who live on fixed incomes like pensioners and workers with weak wages are often negatively impacted by inflation. The reason is that fixed income people and low-wage earners find themselves not holding hard assets and also paying higher and escalating prices for goods and services.

FNB sees a season of high inflation racing towards America:

FNB believes that 3 to 5 % annual inflation is highly possible over the next three to five years. Here are some extenuating and contributing factors:

Demand for higher wages: already we are seeing unions and other organized groups demanding higher wages vs. the creep of inflation

US Tax Code: the US government continues to enact and then extract larger and larger portions of revenue from its citizenry. Leaving average people with fewer and fewer dollars of their own to spend

Rising energy prices: the cost of finding, extracting, refining, transporting and then selling energy products continues to skyrocket. Average consumers find themselves paying higher and higher fees for smaller and smaller increments of energy supplies

Trade wars and unstable global markets: the US consumer finds himself straddling the chasm that the current and not-soon-to-be-resolved trade wars with China and other unfair trading partners creates. Once again, the average consumer is forced to pay up for vital goods and services

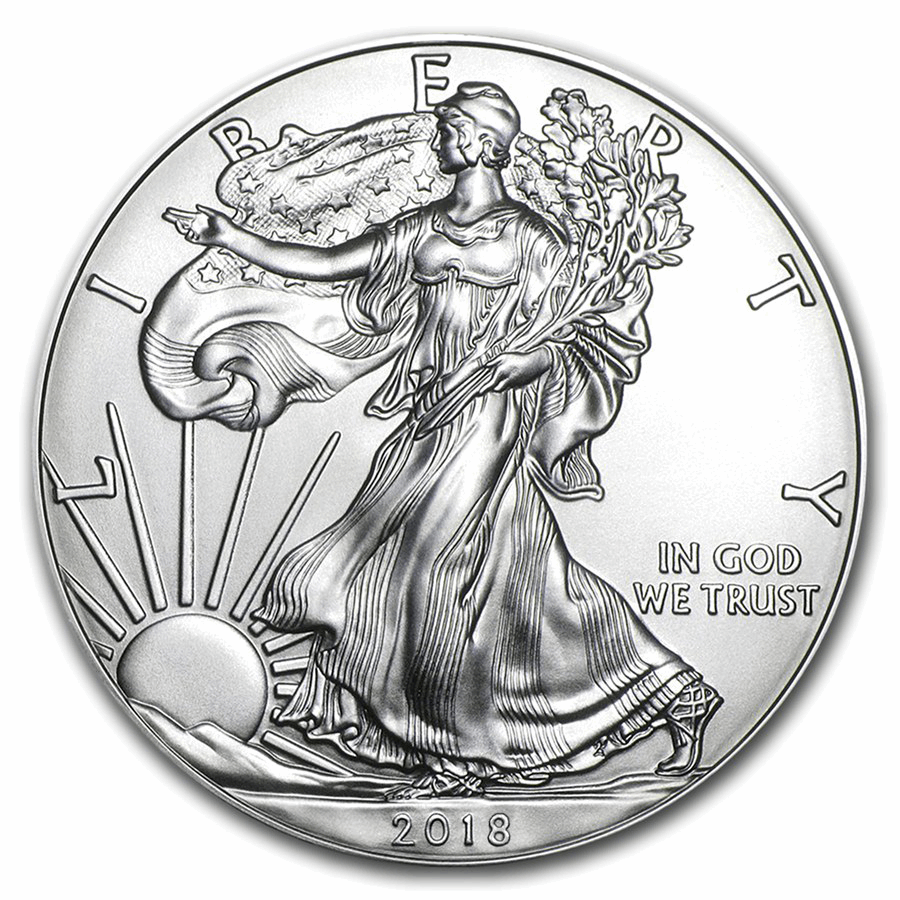

FNB strongly urges all savvy and thoughtful investors to ramp up their physical gold coins, bars and bullion holdings. FNB invites all to visit our website:

www.firstnationalbullion.com

FNB invites all that live in or near our three physical locations in San Diego, Del Mar and Scottsdale to stop in and visit and meet one-on-one with our Team of precious metals experts.

FNB posits and strongly asserts that capitalism and the capacity to own, manage and profit from the collective of private properties and/or business initiatives is a driving force that America and its leaders simply must protect.

FNB remains diligent and unwavering in the call for common, average American people to seek out the Safe Havens of gold and silver coins, and gold and silver bullion.

FNB, a national precious metals industry leader and reputable gold and silver coin dealer urges investors, bond-holders, speculators and all who manage and/or oversee their family’s financial portfolio begin now migrating larger allocations into the historical safe harbors of: Gold and Silver.

Jon Cavuoto,

Founder and Owner,

First National Bullion

For direct consultation with a gold and silver expert contact FNB:

inquiry@fnbcoin.com