Buy Gold and Silver: Presidents and the Federal Reserve: Part One:

Buy GOLD and SILVER: Presidents and the Federal Reserve: Part One:

Gold: $ 1565.50 Silver: $ 18.18 Platinum: $ 963.00 Palladium: $ 2028.00

Dateline: Del Mar, CA: Monday, January 06, 2020

FNB is a precious metals industry leader. Each weekday, we post information and financial facts (and opinions!) that relate directly to the financial markets and also that have direct impact upon the daily lives of investors.

In our last session, FNB concluded our: “2020 Forecast for Gold and Silver.”

In this session, FNB begins a discussion of the rocky relationship that has historically existed between Presidents and The Federal Reserve.

Rocky Relationship Between PRESIDENTS and FEDERAL RESERVE:

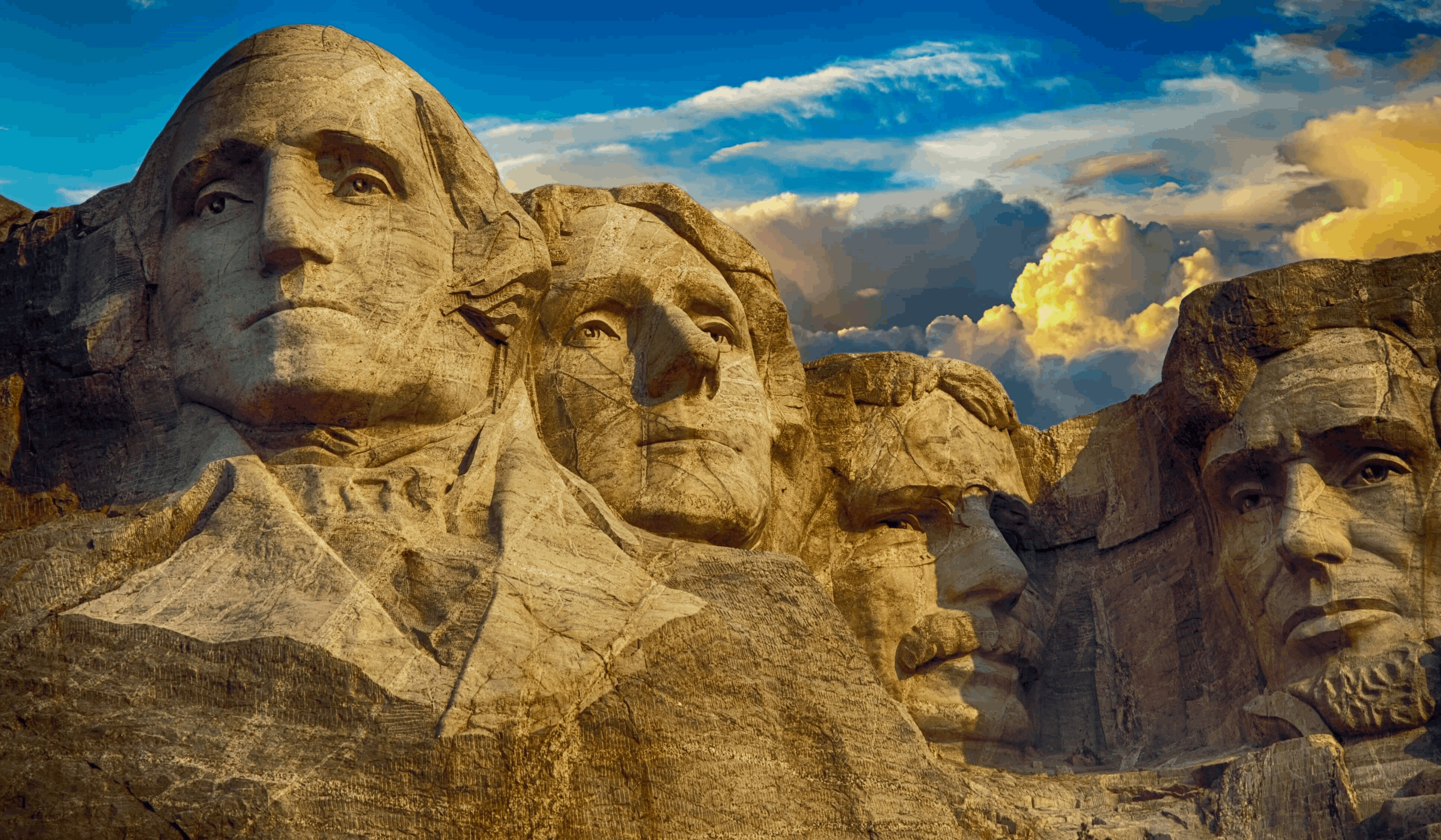

“If the American People ever allow private banks to control the issuance of their currency, first by inflation, then by deflation, the banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered.”

Thomas Jefferson

Since the inception and the creation of the Federal Reserve Bank as the nation’s sole source of monetary policy, virtually every elected President has had some form of major conflict with these non-elected, national money managers.

Here are some brief examples:

Woodrow Wilson, under whose administration the Federal Reserve came into being via ratification of the thirteenth amendment was certain that the Fed Board of his day was sabotaging his presidency

Harry Truman fought and lost multiple and some say ‘epic’ battles with the Fed

Lyndon Johnson reportedly shoved then Fed Chairman of the Board, William McChesny Martin into the wall of his Texas Ranch

President Ronald Reagan is said to have ‘violated’ the independence of the Fed by directly ordering then Chairman Paul Volcker to not raise interest rates during his reelection bid

Richard Nixon is thought to have been the one President that completely dominated The Fed

That President Donald Trump is clashing with current FED administrators seems right in line with the fact that Presidents often believe this group of un-elected bureaucrats do not always have the best interest of the nation as their core priority.

In the next several sessions, FNB is going to take a hard look at how The Fed and duly elected Presidents have clashed swords since 1913.

FNB strongly urges all savvy and thoughtful investors to ramp up their physical gold coins, bars and bullion holdings. FNB invites all to visit our website:

www.firstnationalbullion.com

FNB invites all that live in or near our three physical locations in San Diego, Del Mar and Scottsdale to stop in and visit and meet one-on-one with our Team of precious metals experts.

FNB posits and strongly asserts that capitalism and the capacity to own, manage and profit from the collective of private properties and/or business initiatives is a driving force that America and its leaders simply must protect.

FNB remains diligent and unwavering in the call for common, average American people to seek out the Safe Havens of gold and silver coins, and gold and silver bullion.

FNB, a national precious metals industry leader and reputable gold and silver coin dealer urges investors, bond-holders, speculators and all who manage and/or oversee their family’s financial portfolio begin now migrating larger allocations into the historical safe harbors of: Gold and Silver.

Jon Cavuoto,

Founder and Owner,

First National Bullion

inquiry@fnbcoin.com