Top 5 Lies about Precious Metals Investing

5 Common Myths that Mislead Precious Metals Investors

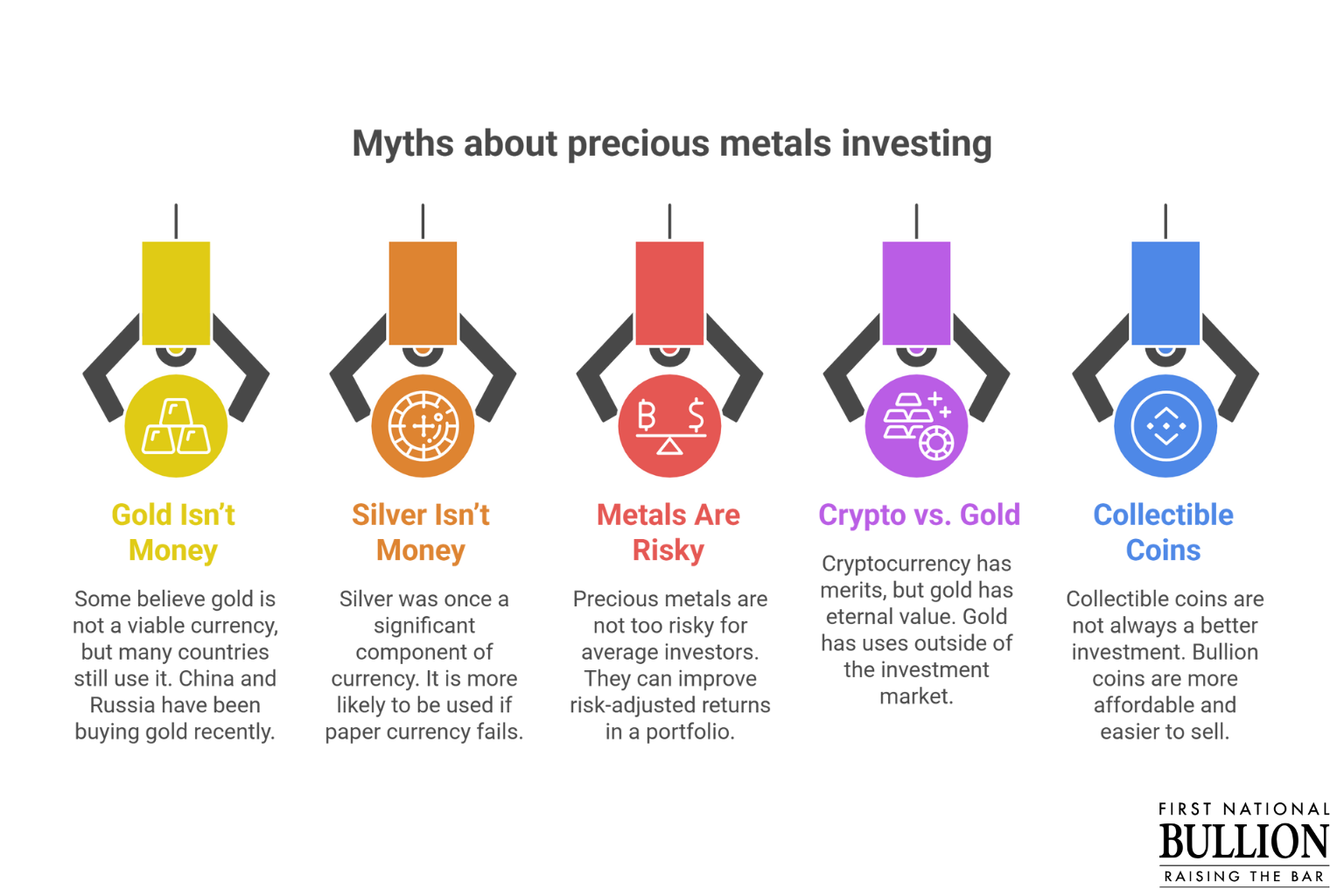

Investing in precious metals is a smart way to diversify your investment portfolio. Unfortunately, some lingering misconceptions make it difficult for investors to make well-informed decisions. Below, we examine five common misconceptions about investing in precious metals.

1. Gold Isn’t Money

Gold has a long history of being used to back up paper currencies. It remains a viable resource for many countries. China and Russia have been making significant gold purchases in recent years, which has led other central banks around the world to follow suit. In 2018, Russia increased its investments by a staggering 68 percent.

2. Silver Isn’t Money

Until 1965, most of the money in circulation contained significant amounts of silver. Since then, silver has been largely removed from coins in circulation minted after that year. The Founding Fathers referred to the new U.S. dollar with grains of silver. A dollar was worth 371.25 grains of silver. Silver isn’t stored in reserve. It’s more likely to be used in the event of issues with paper currency.

3. Precious Metals Are Too Risky for the Average Investor

A study by Ibbotson Associates found that investors who put 7.1 percent to 15.7 percent of their investments in precious metals enjoy impressive risk-adjusted returns. Investing in precious metals is very rarely risky for new or average investors. While you don’t want to invest everything in gold and silver, it’s good to make precious metals part of your portfolio. However, other studies suggest most people aren’t heeding this advice, likely because it’s not given regularly. Gold also has little correlation with the stock market or economic events, which makes it a smart investment choice as well. Gold actually posted gains during the 2002 and 2008 economic downturns. Whether they choose to buy gold bullion or platinum bars, San Diego investors should be reassured by the long history of precious metals being wise long-term investments.

4. Cryptocurrency Is the Future and Gold Is an Old Relic

Digital assets like Bitcoin do have their merits. However, gold is still a worthwhile investment. There’s no way to know what will happen with crypto assets in the future. Gold, on the other hand, has eternal value. Gold is a rare precious metal, and it will always have some degree of value. Precious metals like gold and silver also have uses outside the investment market in various industries like the automotive and space industries. Bitcoin and other digital currencies have no use outside the digital world.

5. Collectible Coins Are a Better Value for Your Investment

There are plenty of ads suggesting that collectible coins are a better investment than regular bullion coins. While there’s some value in collectible coins, they’re usually only appealing to serious investors with knowledge of the stories behind such coins. In most instances, regular bullion coins are a better investment because they’re more affordable and easier to sell. Collectible coins are only valuable if they have special meaning for the buyer, which is rarely the case.

Whether they’re looking for expert advice on investing in precious metals or they know they want to buy gold bullion, San Diego residents should work with trustworthy precious metal dealers who offer high-quality service and have years of experience. Call on the industry-leading professionals at First National Bullion when you’re ready to invest in precious metals, including gold, silver, platinum, and palladium. Give us a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.