Is the World Running Out of Gold?

Is the Global Gold Supply Almost Gone?

Gold isn’t going to be around forever. The good news is gold never goes away completely. For instance, if they buy gold bullion, Carlsbad collectors aren’t going to throw it away or use it up like oil or other fossil fuels. However, they might hold on to that gold for years or decades, so it may not end up back on the market for a long time. Below, we take a closer look at what’s going on with the global supply of gold.

Gold Isn’t Being Discovered as Quickly

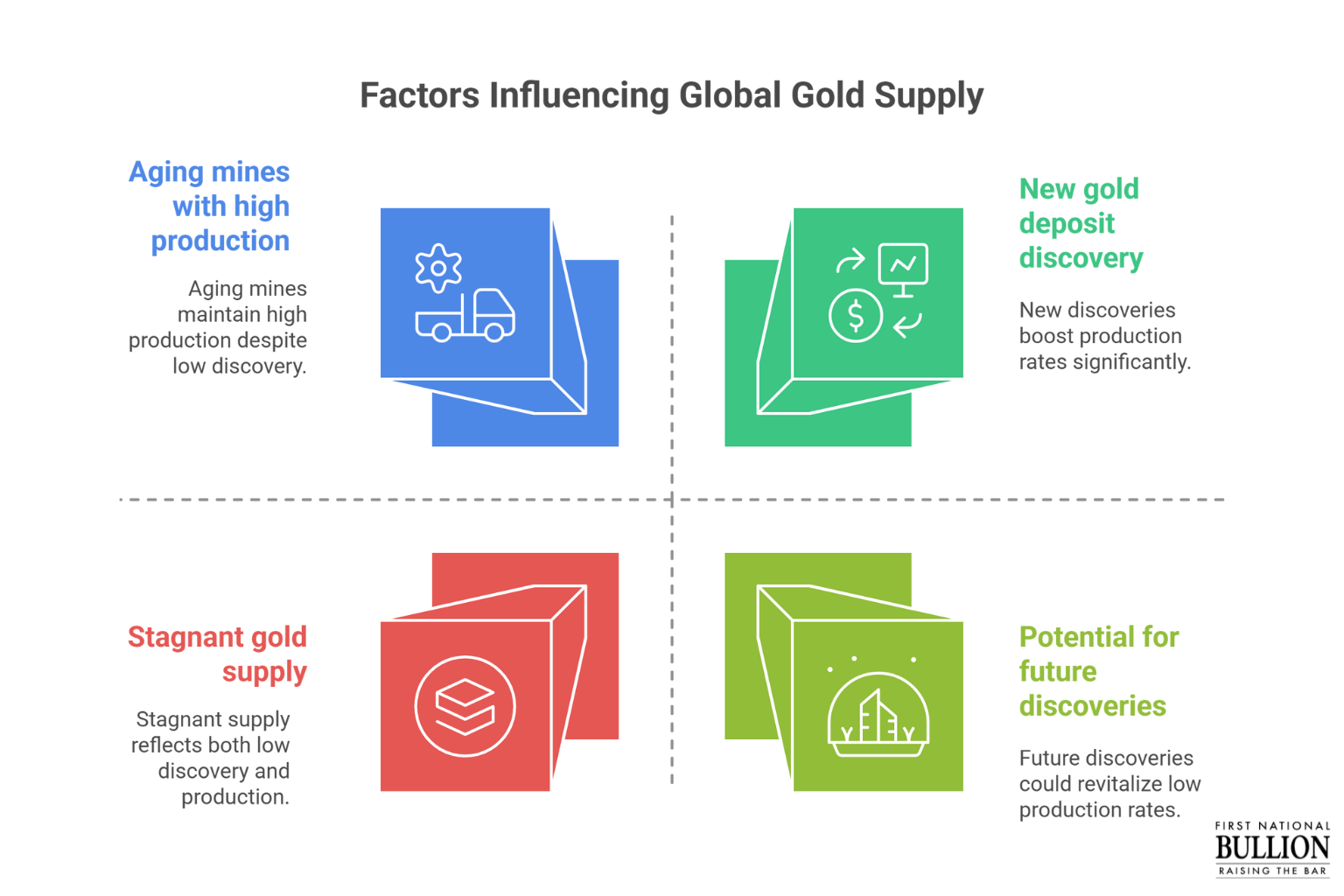

In the 20th century, gold was discovered in massive amounts. This continued until the end of the century. So-called “super pits” include the Witwatersrand Basin in South Africa, Carlin Trend in Nevada, and Australia’s Fimiston Open Pit. However, many of these facilities are getting older and nearing the end of their life cycles. In the 21st century, there have been fewer gold discoveries on a large scale.

Gold Production Is Slowing Down

As mentioned above, many of the world’s gold mines are getting older, which means lower production rates. The Witwatersrand mine had a stellar year in 1970, with miners digging up more than a thousand metric tons of gold. South Africa was once the top producer of gold. Today, however, it’s been surpassed by Russia, China, Australia, and the United States. Gold production has been on a steady decline since the mid-1990s. Additionally, tougher regulations make it difficult for mining companies to keep up with demand.

On a positive note, China houses the world’s deepest mine, at 2.5 miles. However, it’s expensive to bring up gold from deeper regions. There have also been reports of discoveries of a new gold deposit in eastern China.

Mining Companies Aren’t Spending as Much on Exploration

Major mining companies are no longer investing as heavily in the discovery of new gold deposits. This is partially due to the expense involved, although some companies aren’t willing to spend what they used to simply to lower overall operating costs. And when new deposits are found, it takes time to open mines due to various regulations. It can take up to a decade for a mine to open once gold is discovered. It can also be costly to extract gold when it’s located in difficult-to-reach areas. There are also issues with labor shortages or strikes that can slow down production even more and make it less profitable to find new sources of gold.

There Is Good News

There’s always the possibility of new gold discoveries in the coming years or decades. There’s also the potential for new technology to be developed that makes it easier to locate and mine gold. It’s still a good idea to invest in gold. Gold prices are fairly stable. It’s also a reliable investment, since gold is economically sound even if there are issues with the global economy.

Whether they’re looking for expert advice on precious metals supplies or they want to buy gold bars, Carlsbad precious metals collectors should reach out to the trustworthy professionals at First National Bullion. We can answer all your questions and help you find all the information you need on how precious metals can be a valuable part of your portfolio. Give one of our experienced dealers a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.