3 Ways to Make a Winning Investment in Precious Metals

3 Smart Tips for Investing in Gold & Silver without Getting Burned

Precious metals are a smart investment for many people. However, if you’re just getting started, it can be a bit overwhelming. It’s easy to find precious metals online or through television ads, which can only add to the confusion if you’re new to these types of investments. Below, we go over three ways to make a winning investment in precious metals.

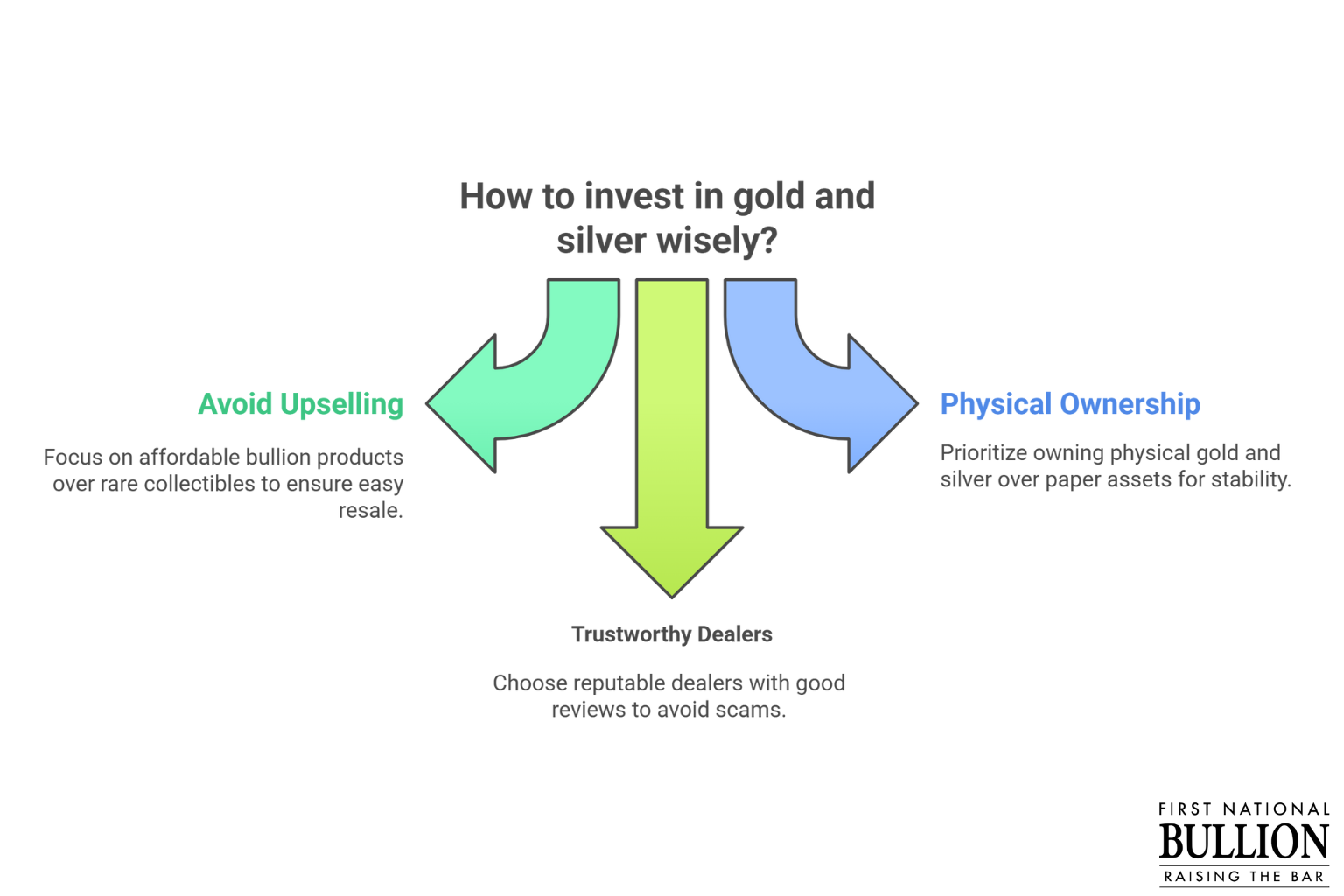

1. Avoid TV or Online Ads that Try to Upsell You to Rare or Collectible Items

We’re referring to those ads featuring well-known spokespeople selling gold and silver coins or bars. What they usually end up doing is trying to upsell you to collectible items or rare coins, rounds, or bars that seem like wise investments.

They often start with affordable items that appear to be a good choice for first-time investors, and most of the time they are. However, they don’t want people to “settle” for their lower-priced products. While they may tell you their rare and collectible items are smart investments because they’re likely to increase in value over time, this is rarely the case. Only serious collectors and investors are interested in such coins or bars. Instead, invest in an affordable bullion product that can be easily sold to other investors who prefer more affordable assets they can sell. When they’re not sure about what type of bullion to buy, such as gold and silver bars, San Diego residents should seek the advice of an experienced, reputable precious metals dealer.

2. Don’t Limit Yourself to Paper Gold and Silver Investments

Financial planners tend to steer clients toward stocks or bonds related to gold and silver. While these investments can be lucrative, they’re also risky. Such assets are tied to the stock market, economic conditions, and other situations such as mine strikes. It’s not good to put all your eggs in one financial basket.

Instead, start with gold and silver products you can physically own and store. Then you can add paper assets to balance out your investment portfolio if you choose. Financial investors and advisors only earn commissions on paper assets tied to gold and silver. Actual gold and silver holdings are often stored and only become viable assets once they’re sold or converted into cash. What’s more, gold has consistently outperformed paper assets. And with the dollar on shaky ground, it makes sense to invest in gold, silver, and other precious metals.

3. Be Careful about Who You Buy From

Don’t simply settle for the lowest price when shopping for gold and silver. There have been plenty of stories about dealers who failed to deliver their advertised products. In some instances, other items are substituted for the advertised products. This is because it’s common practice to pay in advance of delivery. Do your homework first and choose dealers you can trust. Look at things like online reviews to determine if a dealer is really reputable. You can also look for advice from online sites or friends and relatives who have had good experiences with various dealers. Keep in mind the lowest price is only one factor to consider. Look at delivery times and related fees as well to determine if you’re really making a smart purchase.

Whether they’re looking for expert advice on investing in precious metals or they know they want to buy gold, San Diego residents should work with trustworthy precious metal dealers who offer high-quality service and have years of experience. Call on the industry-leading professionals at First National Bullion when you’re ready to invest in precious metals, including gold, silver, platinum, and palladium. Give us a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.