How Does Gold Perform as a Long-Term Investment?

Gold reliably increases in value over time, but a prudent investor will of course want to compare its performance to other kinds of investments. This is often difficult because gold traditionally doesn’t follow the same trends as other investments, and its future performance is less predictable than the returns on a diversified portfolio of traditional stocks. Significant changes in the price of gold tend to be driven by unpredictable historical events, which makes forecasting changes difficult. Gold can therefore be an important part of your overall investing strategy, but it must be used appropriately. The first step in incorporating gold into your investment portfolio is to work with a reputable firm, such as First National Bullion and Coin. Scottsdale residents can rely on our unmatched professionalism and expertise when they’re ready to invest in gold and other precious metals.

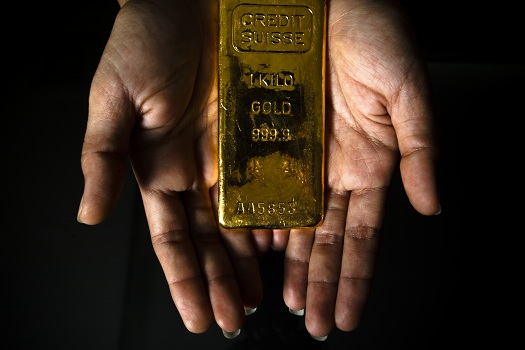

Gold Is a Safe Investment

The most common reason people invest in gold is as a safety net. Regardless of changes in the stock market, gold always retains significant value due to its rarity and use in jewelry and industrial applications. This means an investment portfolio that includes gold is likely to always retain value.

Gold can act as a hedge against normal stock market dips and provide protection against major economic emergencies. During the Great Depression, gold retained its value when most other investments became worthless. During the Weimar Republic’s currency collapse, runaway inflation reduced the value of money itself to the point of total worthlessness, but physical gold retained its value. Because of this stability, many investors choose to include gold in their portfolios as security against economic downturns, from minor to catastrophic.

In Prosperous Times, Gold Sees Smaller Returns than Conventional Stocks

The flip side of investing in gold is that as a safer investment, it tends to not see the same returns other investments do the majority of the time. This effect is magnified when examined over longer periods: there have been many specific periods during which economic stagnation and recession have caused gold to outperform stocks, but looking back over the course of several decades will typically smooth out those anomalies and show stocks outperforming gold. As a result, both the anticipated length of the investment period and the expected economic conditions in the near future must be considered.

An investor planning to hold assets for many decades will most likely prefer to invest more heavily in a diversified stock portfolio with gold as a safety net. On the other hand, an investor anticipating economic disruption and falling stock prices in the near future might decide to invest more heavily in gold.

Today, many investors are uncertain about the future of the economy, and they’re buying gold in greater quantities in hopes of preserving and increasing their wealth in the face of a potential drop in the stock market. This increased level of investment has already resulted in increased prices among all precious metals. As a traditional reliable store of value, this demand may continue to increase, accelerating the rise in gold’s value.

If you’re building your investment portfolio and looking for the best place to purchase Scottsdale gold and bullion, reach out to the trustworthy professionals at First National Bullion. We can answer all your questions and help you find the information you need on how gold can figure into your investment planning decisions. Give one of our experienced dealers a call today at 480-546-5089.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.