How Owning Precious Metals Can Protect Wealth against Hackers

Why Precious Metals Are a Smart Shield against Cyber Threats

Electronic hackers are nothing new. However, they can still do significant damage. You’ve probably heard about allegations of Russian hackers involved with government-related events, including the 2016 and 2020 presidential elections here in the U.S. There have also been issues with cryptocurrencies and electronic banking. Fortunately, there are steps you can take to reduce your risk of being affected by hackers. One of these is to invest in precious metals.

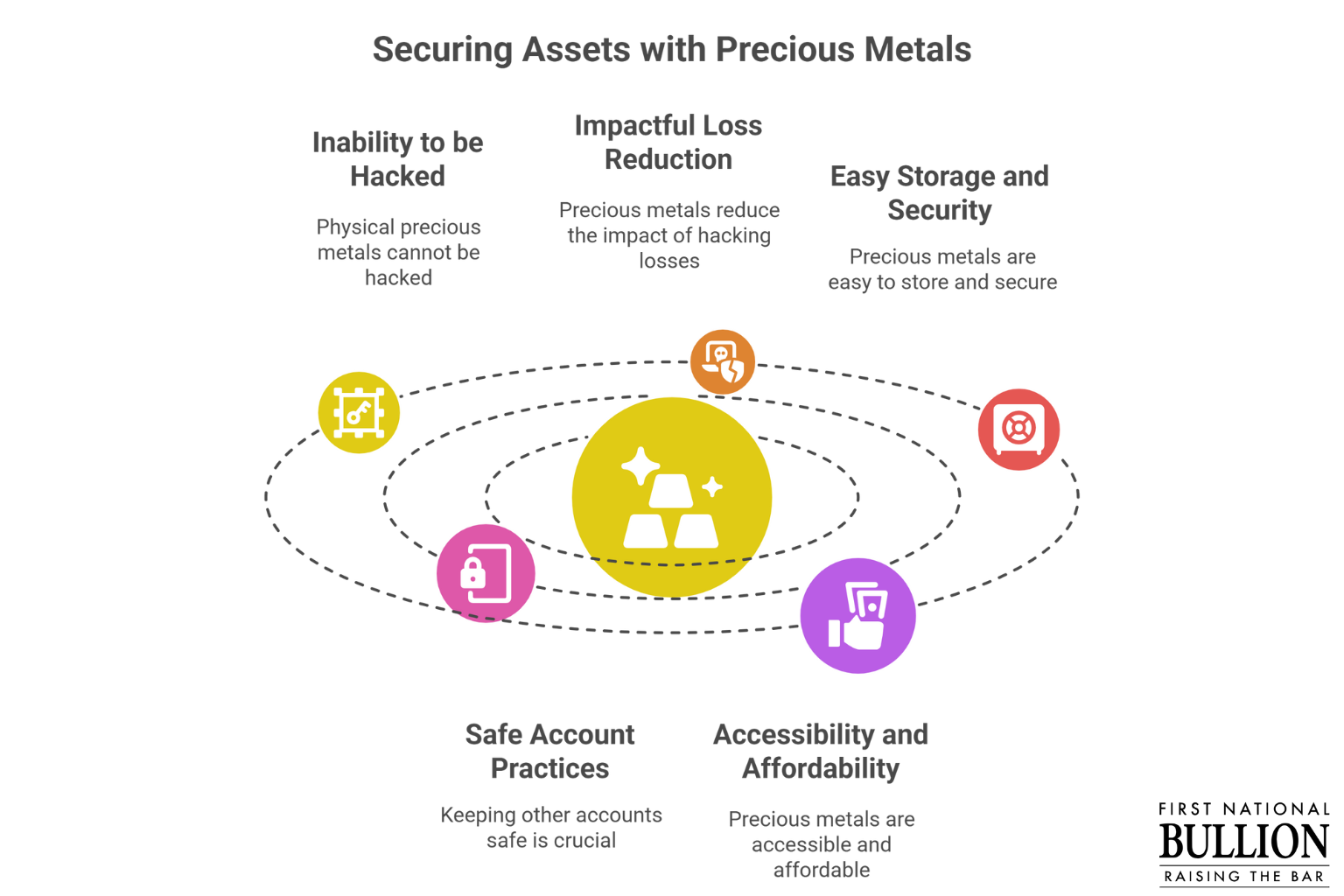

Precious Metals Can’t Be Hacked

If you invest in precious metals, there’s only a risk of hacking if you tie your investments to gold or silver bonds or other sources of funding connected to the internet. Fortunately, physical gold and silver can’t be hacked. For example, if they buy gold bullion, Carlsbad collectors will have something they can hold on to and store at home or in a safe location.

Precious Metals Make Hacking Losses Less Impactful

You don’t have to give up your financial accounts tied to paper or electronic assets. However, if you do have accounts that are hacked, you can take comfort in knowing you still have tangible assets if you also have gold or silver bars, coins, or rounds.

Precious Metals Are Easy to Store and Secure

You won’t have to worry about theft as much with precious metals. You can store your physical gold, silver, platinum, or palladium products in a secure safe or in a facility that houses precious metals. There are very few instances of precious metals being stolen if they’re secured properly. The good thing about storing gold or silver in an off-site storage location is that such places often have added security features and insurance.

However, it may be a good idea to avoid storing your precious metals in a safety deposit box at your local bank, since these boxes may be raided or rendered inaccessible during a crisis. This doesn’t mean there’s no risk of theft, although it’s certainly not as high as what’s common with electronic assets. Also, don’t let friends and neighbors know you’re storing gold and silver products in your home if you use a home safe.

You Should Keep Your Other Accounts Safe

Take steps to keep other assets safe, especially if your portfolio includes gold stocks or other assets linked to the electronic world. Steps to take include:

- Checking your credit report frequently for signs of hacking

- Not storing information about your financial accounts on your phone

- Minimizing the amount of banking you do online as much as possible

- Installing anti-virus software on your devices and keeping it up to date

- Keeping accurate records of your account activities

- Strengthening your passwords to include characters and other features that make them difficult to guess

Obtaining Precious Metals Is Easy and Affordable

Fortunately, it’s fairly easy to get started with physical precious metals. It’s best to make your purchases from reputable sellers like precious metals dealers. It’s also a good idea to work with a financial advisor who is familiar with precious metals to determine what can work best for you. Lastly, you don’t have to spend a fortune to obtain precious metals. These products are available in a wide range of prices and sizes.

If you decide to purchase precious metals in physical form, make sure to work with experienced trustworthy professionals. Whether they’re looking to buy gold bullion, platinum coins, or silver bars, Carlsbad residents can trust the reputable dealers at First National Bullion. We’re a boutique precious metals firm with highly experienced professionals. If you’re looking to add precious metals to your collection, call us today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.