How to Move Part of Your Savings into Gold or Silver Accounts

How to Switch Some of Your Savings to a Low-Cost Gold or Silver Account

The U.S. dollar isn’t always the go-to investment choice. Many banks are already struggling to remain solvent. For this reason, it’s a good idea to invest in gold and silver. Keep reading as the precious metals experts from First National Bullion, the silver and gold dealers Carlsbad collectors rely on for outstanding quality and service, discuss how you can swap some of your savings for gold and/or silver with a vault storage account.

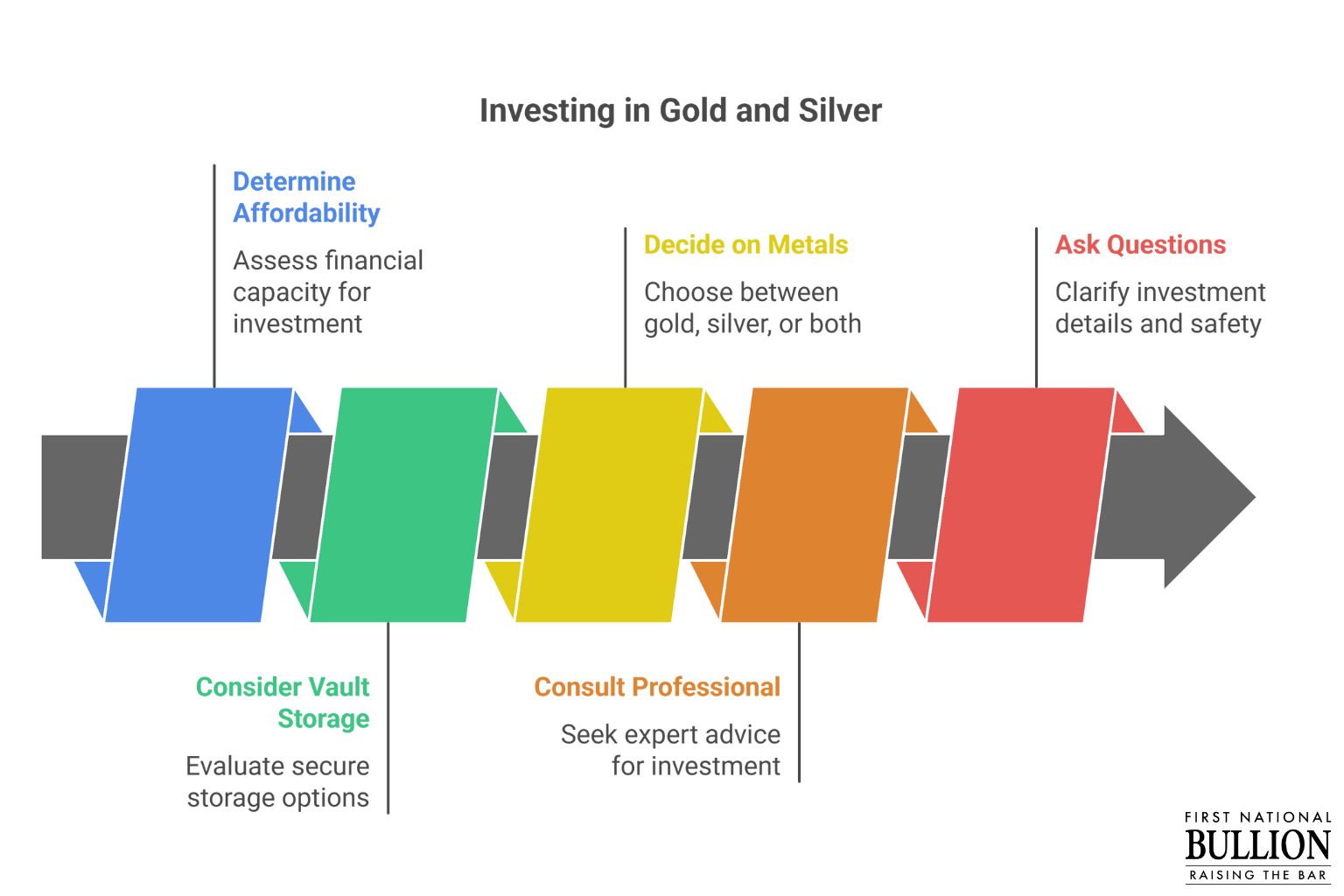

Determine What You Can Realistically Afford

Take a moment to determine what you can afford. Larger purchases can be a major investment for new and experienced investors. Check spot prices often and look for deals on silver and gold purchases. Some dealers offer discounts on larger quantities of gold and silver. Keep in mind you don’t have to invest all of your savings in gold and silver. You should still retain some savings to balance out your portfolio.

Consider Creating a Vault Storage Account

Gold and silver can be stored in your home, at a local bank, or in a storage vault. Home storage is fine for small quantities of gold and silver. However, it’s best to store larger quantities in a storage vault. Storage vaults often offer insurance and other protections for your gold and silver purchases. You won’t need to install a safe in your home or arrange for an armored car, either. In this instance, you would have an account for vault storage that would allow you to manage your gold and silver holdings. All you need to set up an account is to provide information about your current savings account and decide how much gold or silver you wish to store. The gold and silver are purchased separately and stored in the facility.

Decide on Gold, Silver, or Both

Gold offers greater stability and a proven track record for investments, making it a good choice for conservative investors. Gold is a smart investment if you prefer something with more potential for a larger payoff later on. Silver is cheaper to purchase, although it’s still useful for investment purposes. Silver tends to have more price swings due to its many industrial uses, which gives you more of a chance to buy and sell and make a profit.

Work with an Investment Professional Specializing in Precious Metals

Investment professionals know how to provide customized plans and advice. This is a step worth taking if you’re new to gold and silver investments or not sure where to begin, Make sure to ask important questions (this applies to vault storage as well, to some extent), such as:

- Are there any fees associated with swapping gold or silver for savings?

- How much gold or silver should I initially invest in?

- How long does it take for gold and silver prices to change?

- How safe is the storage facility where my gold and silver will be held?

- What kinds of reports do I get about how my investments are doing?

- Am I notified before any purchases or sales are made?

- Can I access my gold and silver whenever I wish to?

- How much of my savings should be invested in gold or silver stocks and bonds (if any)?

Keep in mind gold and silver are solid investments with the potential for long-term payoffs and stability. Gold, in particular, has a long history of being a reliable hedge against inflation and other market and economic issues.

Whether they’re making decisions about investing in gold and silver accounts or looking for the best place to buy platinum bars, Carlsbad residents should reach out to the trustworthy professionals at First National Bullion. We can answer all your questions and help you understand how precious metals can figure into your investment planning decisions. Give one of our experienced dealers a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.