Is Now the Time for a Precious Metals IRA?

Is Investing in a Precious Metals IRA a Smart Move Right Now?

The stock market is doing very well these days. This includes the precious metals market. In fact, gold prices have risen 35 percent since lows earlier this year, the S&P 500 is nearly 50 percent higher, and stocks have outperformed what was predicted by experts. This brings us to the topic of whether now is the right time to invest in a precious metals IRA.

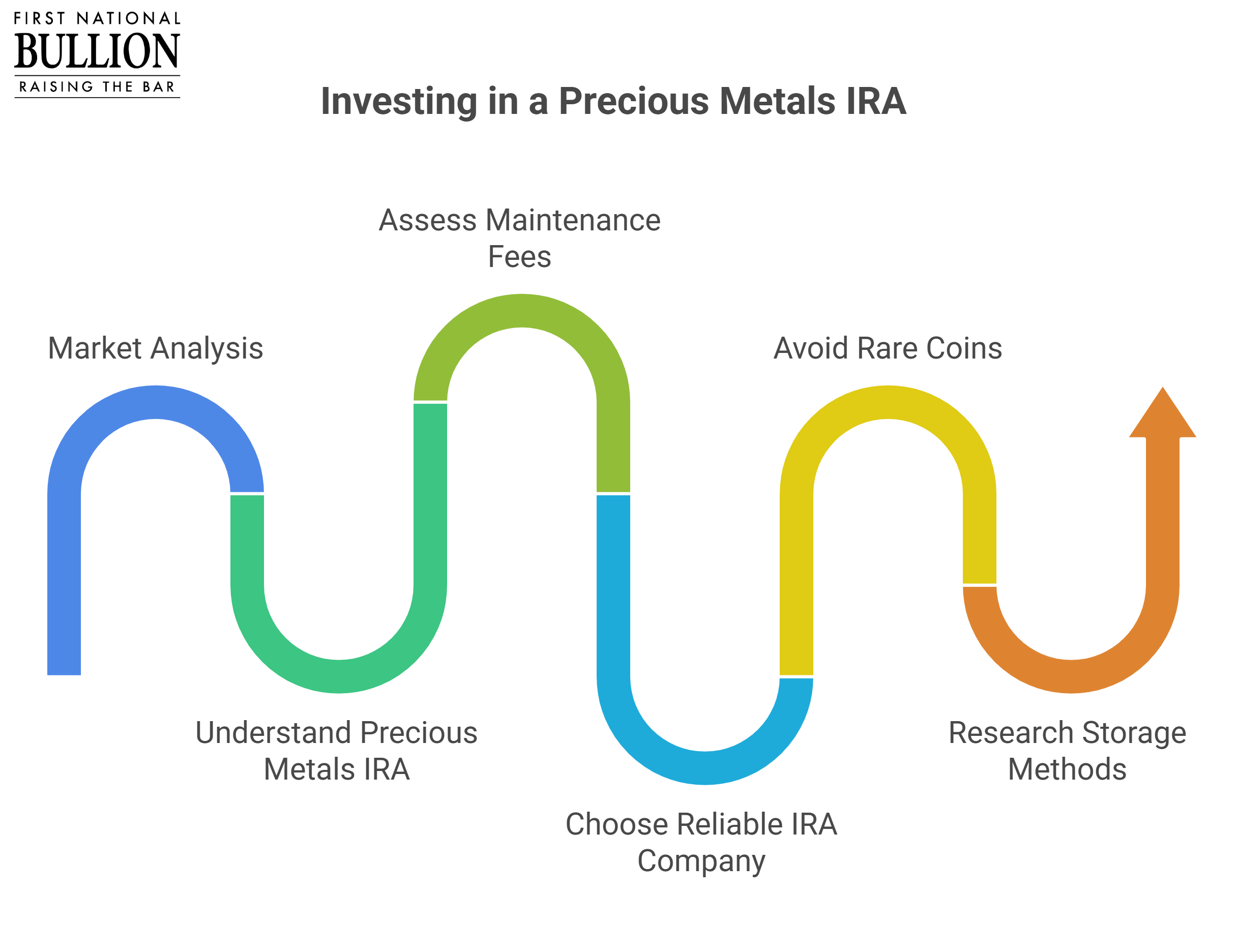

Learn What a Precious Metals IRA Is

A precious metals IRA allows you to hold physical precious metals in your retirement account. A precious metals IRA holds tangible assets, requiring a specialized custodian and third-party storage for the metals. These accounts offer tax advantages just like those standard IRAs offer. You do pay higher fees, and there are specific IRS rules for the types of metals and their storage.

Find Out about the Maintenance Fees

Annual maintenance and storage fees vary based on factors such as the amount of precious metals and where you’re storing them. If you invested $100,000 in IRA funds in physical gold, for example, you might pay 35 basis points (.0035) for the first year and 20 basis points (.002) for subsequent years. Make sure to get an accurate quote first before agreeing to any fees.

Pick a Reliable IRA Company

Take time to find a reliable firm to manage your gold, silver, palladium, or other precious metals IRA. Look at things like reputation and years in business. Also, find out what fees apply. If you plan to do business in person, see what kind of customer service you get when you call or email. Also, ask if they have secure storage facilities like the trusted depositories at First National Bullion—the best place to buy gold in San Diego—or if they’ll work with your preferred storage facility to ship your precious metals when you sell them.

Stay Away from Rare or Proof Coins

Some IRA custodians steer clients toward rare or proof coins for IRA funds. The problem is these coins rarely appeal to the average buyer. You could end up with coins in storage for several years. You would end up paying the fees for storage without the ability to easily sell those coins. Instead, invest in traditional forms of precious metals that are easier to buy and sell. A reliable custodian will give you choices and steer you away from unwise ones.

Research Storage Methods

It’s common for investors to prefer to keep coins or bars close to home. However, this doesn’t mean you need to pick the first place you find near your home. Do your homework first and check on such things as storage fees and security. You should also check on customer service and how easy it is to access your precious metals. Some facilities only store precious metals and leave it up to you to remove and ship your metals. Others will take care of this for you and give you online access to track how everything is going with your precious metals.

Whether they’re looking for expert advice on any aspects of investing in precious metals or they’re looking for the best place to buy silver bullion, San Diego collectors should work with trustworthy experts who offer high-quality service and have years of experience. Call on the industry-leading professionals at First National Bullion when you’re ready to invest in precious metals, including gold, silver, platinum, and palladium. Give us a call today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.