6 Things Naysayers of Precious Metals Get Wrong

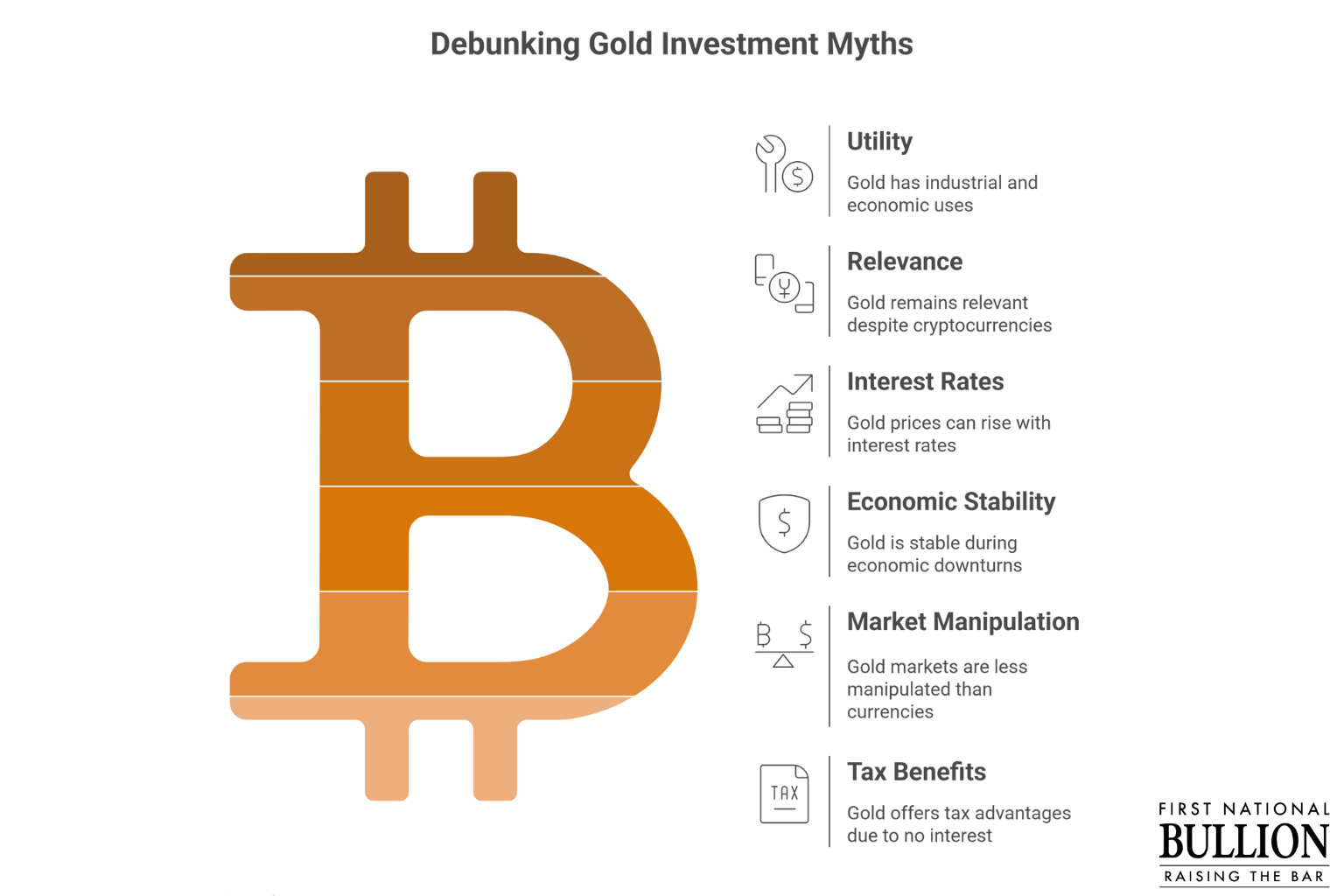

6 Common Myths about Investing in Precious Metals Debunked

Physical gold has many perks. That being said, there are some lingering misconceptions about gold that cause investors to stay away from a precious metal that’s been known to humans for thousands of years. Below, the precious metals experts from First National Bullion, the best place to buy gold in Carlsbad, go over six things naysayers of precious metals get wrong.

1. Gold Has No Utility

Even if gold didn’t exist as bars and coins, people would still dig it up. Gold also has industrial functions, and it’s used for architectural designs, dental features, electronics, and much more. It’s also just as valuable as a sports car or anything else money can buy. It’s also useful in the event of currency collapses and economic downturns.

2. Cryptocurrencies Are the Future, Gold Is the Past

While there’s much to appreciate about electronic currencies, gold is very much relevant and useful. Central banks still use gold to back up their paper currencies. Also, there are cryptocurrencies in the works that will be backed by silver and gold. When paper money came on the scene, people said the same thing about gold. It’s a precious metal that’s far from being obsolete.

3. If Interest Rates Rise, Gold Prices Won’t Go Up

This lingering misconception has been dispelled several times over. Back in the late 1970s, gold prices rose steadily in line with high interest rates until normal interest rates exceeded inflation rates. In 2014, 2015, and 2016, rate hikes by the Federal Reserve were matched by gold and silver price spikes.

4. If the Economy Goes South, Gold Is Worthless

Gold is one of the least sensitive investments when it comes to economic fluctuations and downturns. In 2008, when the economy took a serious nosedive, gold posted gains for the year. In more recent years, gold has proven to be stable and reliable even when the economy isn’t doing so great.

5. Gold Is Influenced by Market Manipulation that Makes It Difficult to Invest Wisely

There’s a difference between paper manipulation with currencies and gold and silver market influences. While big banks often artificially inflate currency values, physical gold markets often work in reverse. In some instances, gold prices are artificially driven down when paper markets are heading in the other direction. In this instance, gold is a smart investment, since mining companies often lower production rates if gold prices are too low. This eventually creates a shortage in supply as demand goes up, which means you can sell your gold at a profit.

6. Gold Pays No Interest, So It's a Poor Investment

It’s true there’s no interest collected or paid on physical gold. However, there are perks associated with this particular feature. If you hold on to your gold, you won’t have to pay any taxes on it until you sell it. Work with a financial advisor to determine what’s going to work well for your investment goals.

If you’re considering investing in precious metals, don’t let misconceptions guide your decision—seek advice from trustworthy professionals with years of expertise. No matter what type of precious metals they’re looking to buy or sell, from silver bullion to gold coins or platinum bars, Carlsbad residents trust the reputable dealers at First National Bullion. You can rely on our experienced professionals when you’re looking to add precious metals to your collection or investment portfolio. Call one of our precious metals experts today.

The statements made in this blog are opinions, and past performance is not indicative of future returns. Precious metals, like all investments, carry risk. Precious metals and coins may appreciate, depreciate, or stay the same in cash value depending on a variety of factors. First National Bullion does not guarantee, and its website and employees make no representation, that any metals for sale will appreciate sufficiently to earn the customers a profit. The decision to buy, sell, or borrow precious metals and which precious metals to purchase, borrow, or sell are made at the customer’s sole discretion.