Buy Gold and Silver: Presidents and the Federal Reserve: Part Two:

Buy GOLD and SILVER: Presidents and the Federal Reserve: Part Two:

Gold: $ 1572.40 Silver: $ 18.41 Platinum: $ 969.00 Palladium: $ 2048.00

Dateline: Del Mar, CA: Tuesday, January 07, 2020

FNB is a precious metals industry leader. Each weekday, we post information and financial facts (and opinions!) that relate directly to the financial markets and also that have direct impact upon the daily lives of investors.

In our last session, FNB began a discussion of the rocky relationship that has historically existed between Presidents and The Federal Reserve.

In this session, FNB examines how, under President Woodrow Wilson, The Federal Reserve Came into existence.

Rocky Relationship Between PRESIDENTS and FEDERAL RESERVE:

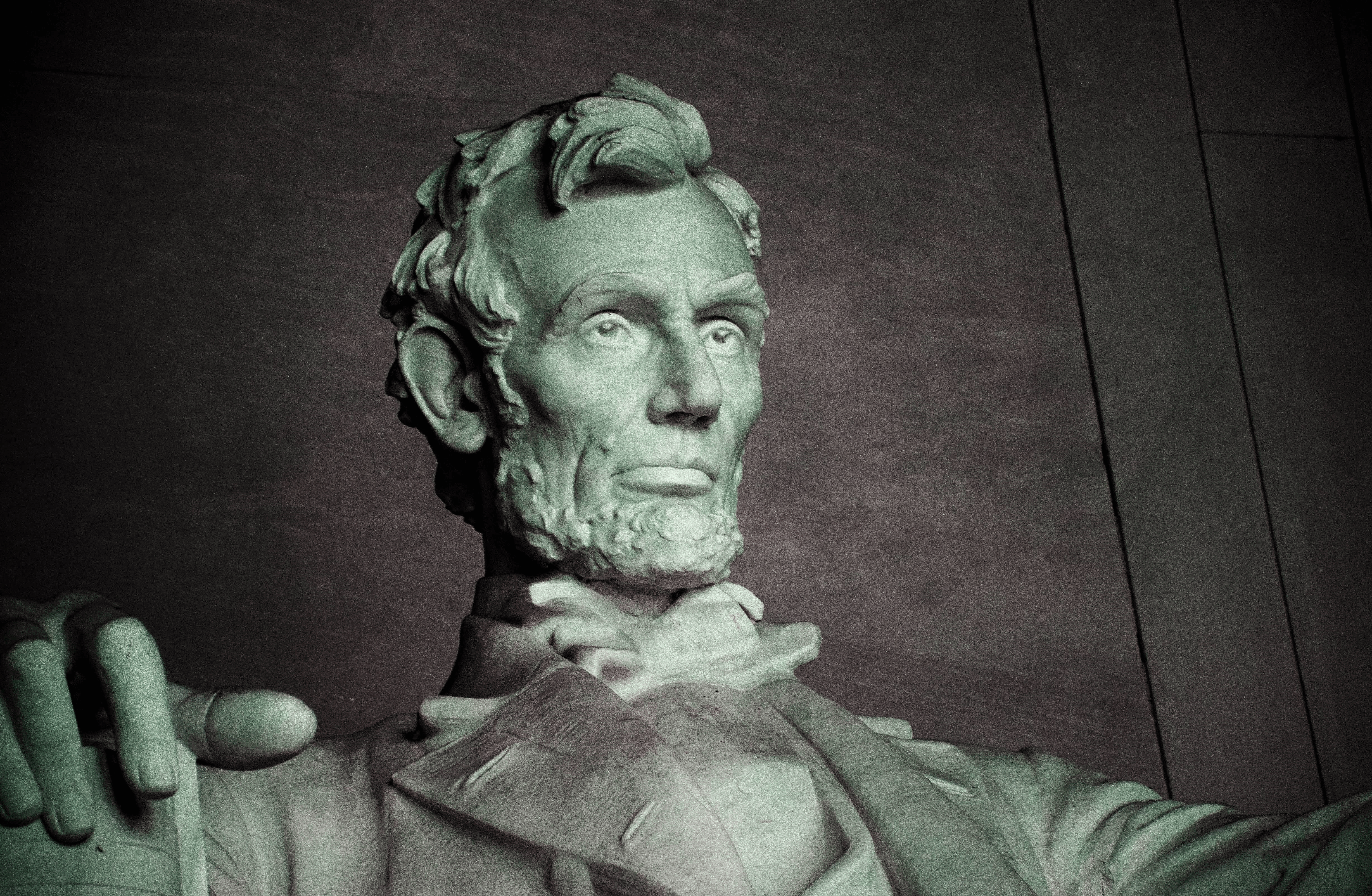

“History records that the money changers have used every form of abuse, intrigue, intimidation, deceit and violent means possible to maintain their control over governments by controlling money and its issuance.”

James Madison

The year was 1895. The United States of America was enmeshed in one of the nastiest depressionary economic cycles since its inception. The then President, Grover Cleveland turned to ‘wealthy individuals’ to bail out the ailing nation.

This economic downturn, more than any other event led to a nearly two decade search for a way to stabilize the nation’s economy and gain full control of the nation’s currency.

In 1913, under then President Woodrow Wilson, in a secret and to this day highly controversial series of meetings at a faraway duck lodge, the nation’s wealthy elitists put together the component parts that became: The Federal Reserve.

The Federal Reserve Bank:

The big result of this confederacy of rich, elite bankers was the establishment of the Federal Reserve Bank. Here are some facts about the Federal Reserve that all investors should know:

The Fed is a two-part structure

Part One of The Fed is a centralized ‘Board of Governors’ that work in Washington, D.C.

Part Two of The Fed is a decentralized network of 12 ‘Federal Reserve Banks’ that are strategically located throughout the county

The Nation’s monetary policy is set by the FOMC

The FOMC (The Federal Open Market Committee) includes members of the BOG (Board of Governors) and the Twelve member Presidents of the local reserve branches

The Fed is set up with the intent of ensuring that the nation’s monetary policy is insulated vs. political pressure

The Fed is supposedly ‘apolitical’ and thus shielded from the interference from all factions of the federal government

The Fed is supposedly ‘self-financed’ by and through its own member banks’ resources vs. congressional appropriation

The Fed regularly reports to Congress on monetary policy and the nation’s economic progress

To believe that The Fed is ‘apolitical’ and not impacted or affected by political forces is foolish.

In our next session, FNB will look into how some of our nation’s Presidents have run into deep conflict with this group of unelected elitists.

FNB strongly urges all savvy and thoughtful investors to ramp up their physical gold coins, bars and bullion holdings. FNB invites all to visit our website:

www.firstnationalbullion.com

FNB invites all that live in or near our three physical locations in San Diego, Del Mar and Scottsdale to stop in and visit and meet one-on-one with our Team of precious metals experts.

FNB posits and strongly asserts that capitalism and the capacity to own, manage and profit from the collective of private properties and/or business initiatives is a driving force that America and its leaders simply must protect.

FNB remains diligent and unwavering in the call for common, average American people to seek out the Safe Havens of gold and silver coins, and gold and silver bullion.

FNB, a national precious metals industry leader and reputable gold and silver coin dealer urges investors, bond-holders, speculators and all who manage and/or oversee their family’s financial portfolio begin now migrating larger allocations into the historical safe harbors of: Gold and Silver.

Jon Cavuoto,

Founder and Owner,

First National Bullion

inquiry@fnbcoin.com