Gold News! Central Banks Hoard Gold and Silver Part Four. The Struggle for Global Financial Dominance. Buy Gold and Silver.

Gold: $ 1295.00 Silver: $ 15.07 Platinum:: $ 846.00 Palladium: $ 1364.00

Dateline: Del Mar, CA: Thursday, March 28, 2019

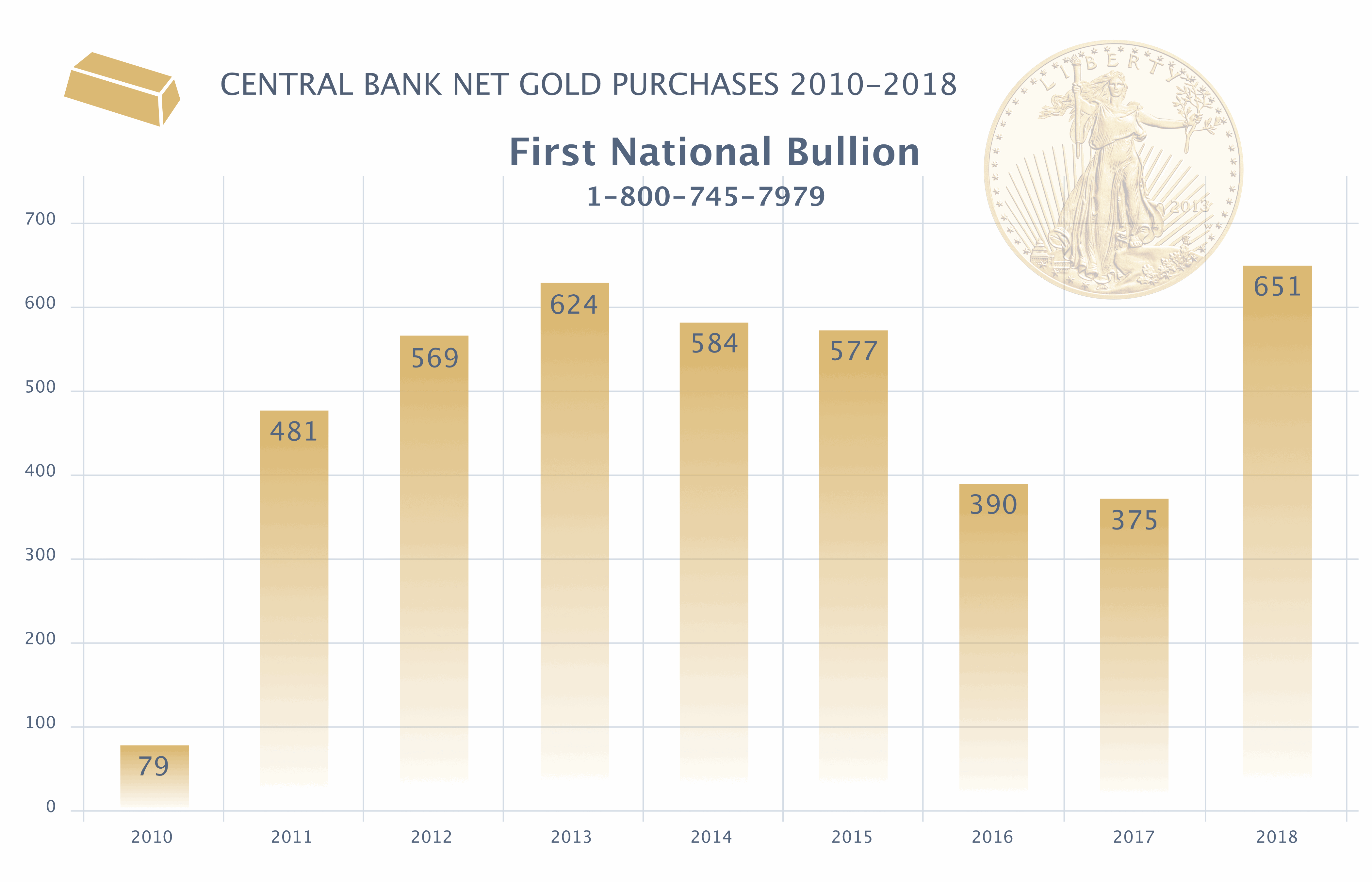

FNB believes there are multiple, deeply-interconnected and equally-balanced reasons why Central Banks globally are aggressively and openly purchasing and then hoarding + stockpiling seeming mountains of gold and silver bullion.

Obviously, central bankers see red-flags in both national and global economies either forming up, or appearing on their financial radar scopes. These red flags cannot be ignored.

Remember and Keep in Mind: “The central bankers and the institutions they oversee have but one mandate: Protect the Institution’s Assets and Deep Reserves.”

It’s equally obvious that key markers and key global events influence central bankers’ decision making processes. In this session, FNB addresses: The Struggle Between Nations of Global Financial Dominance.

Nation vs.Nation RE: Global Financial Dominance:

The previous session focused upon, “Petroleum as a Global Economic Determinant.” The focus of that piece highlighted the stone-cold-fact that the world economy as it hums along right now is 100 % beholden to the historic strength of the US Dollar.

This to me is an indisputable fact. Now, as stated in that piece, there are other national currencies vying for their spot in the sunlight. Countries like: China, Russia, India, Iran and even some of the heretofore hardcore US allies now press their currencies into the mix. What this means is that the worldwide dependence upon US Dollars to enact and complete trade agreements is dwindling.

As the US Dollar’s dominance and influence and necessity as a global exchange requirement lessens, what happens is that gaps appear. These gaps that appear are something akin to slight openings in a fisherman’s net.

As the gap appear in the global financial infrastructure, and as other countries patch these gaps thru the use and deployment and then decision to abandon the US Dollar for their future transactions, what you see is financial struggles happening on a global stage.

Global Stage Positioning and Outright Replacement:

The scenes are taking place almost hourly now. Transactions open for: oil, natural gas, rare-earth minerals, commodities of every kind and stripe and every type of good or service that a nation needs and requires to push its economy forward.

Previously, 100 % of these events were settled and satisfied in US Dollars. Now, there are other available options. Nations now are choosing to satisfy these purchases and sales in their own currencies or, some other currency other than the US Dollar.

This global positioning for reserve currency may not seem to be that big an issue now. As the current environment still sees the large majority of national sales completed and satisfied by and through the US Dollar. But, the facts are in: the US Dollar now has open and very assertive currency competitors.

These currency competitors have openly declared their national intent is to nudge wherever possible the US Dollar off of the preeminent role of ‘reserve currency’ and to replace that vaulted spot with either their own national currency or some other nation’s currency.

Make no mistake: there is an open, and outright financial conflict being waged right now in boardrooms and on trading platforms to find ways to squeeze the US Dollar out of its renowned position of fiscal preeminence and to replace this with other competitors’ currencies.

Where this lands in the next 5 to 10 years is anybody’s guess. But one thing is certain, the US Dollar now has open competition for its reserve currency status.

Next time, FNB addresses how this open competition for reserve currency status causes ripples in the markets. And how this open competition causes instability across multiple trade channels. Trade channels that once operated with fixed and closed certainties.

FNB posits and strongly asserts that capitalism and the capacity to own, manage and profit from the collective of private properties and/or business initiatives is a driving force that America and its leaders simply must protect.

FNB remains diligent and unwavering in the call for common, average American people to seek out the Safe Havens of gold and silver coins, and gold and silver bullion.

FNB, a national precious metals industry leader and reputable gold and silver coin dealer urges investors, bond-holders, speculators and all who manage and/or oversee their family’s financial portfolio begin now migrating larger allocations into the historical safe harbors of: Gold and Silver.

Jon Cavuoto,

Founder and Owner,

First Nation Bullion

For direct consultation with a gold and silver expert contact FNB:

1-800-745-7979